Uniswap V3 Development Book

Welcome to the world of decentralized finances and automated market makers! This book will be your guide in this mysterious and amusing world! Together, we’ll build one of the most interesting and important applications, which serves as a pillar of today’s decentralized finances–Uniswap V3!

This book will guide you through the development of a decentralized application, including:

- smart-contract development (in Solidity);

- contracts testing and deployment (using Forge and Anvil from Foundry);

- design and mathematics of a decentralized exchange;

- development of a front-end application for the exchange (React and MetaMask).

This book is not for complete beginners.

I expect you to be an experienced developer, who has ever programmed in any programming language. It’ll also be helpful if you know the syntax of Solidity, the main programming language of this book. If not, it’s not a big problem: we’ll learn a lot about Solidity and Ethereum Virtual Machine during our journey.

However, this book is for blockchain beginners.

If you only heard about blockchains and were interested but haven’t had a chance to dive deeper, this book is for you! Yes, for you! You’ll learn how to develop for blockchains (specifically, Ethereum), how blockchains work, how to program and deploy smart contracts, and how to run and test them on your computer.

Alright, let’s get started!

Useful Links

- This book is available at: https://uniswapv3book.com/

- This book is hosted on GitHub: https://github.com/Jeiwan/uniswapv3-book

- All source codes are hosted in a separate repo: https://github.com/Jeiwan/uniswapv3-code

- If you think you can help Uniswap, they have a grants program.

- If you’re interested in DeFi and blockchains, follow me on Twitter.

Questions?

Each milestone has its section in the GitHub Discussions. Don’t hesitate to ask questions about anything that’s not clear in the book!

Where to Start for a Complete Beginner?

This book will be easy for those who know something about constant-function market makers and Uniswap. If you’re a complete beginner in decentralized exchanges, here’s how I’d recommend starting:

- Read my Uniswap V1 series. It covers the very basics of Uniswap, and the code is much simpler. If you have some experience with Solidity, skip the code since it’s very basic and Uniswap V2 does it better.

- Read my Uniswap V2 series. I don’t go too deep into the math and underlying concepts here since they’re covered in the V1 series, but the code of V2 is worth getting familiar with–it’ll hopefully teach you a different way of thinking about smart contracts programming (it’s not how we usually write programs).

If math is an issue, consider going through Algebra 1 and Algebra 2 courses on Khan Academy. The math of Uniswap is not hard, but it requires the skill of basic algebraic manipulations.

Uniswap Grants Program

To write this book, I received a grant from Uniswap Foundation. Without the grant, I wouldn’t probably have had enough motivation and patience to dig Uniswap into its deepest depths and finish the book. The grant is also the main reason why the book is open-source and free for anyone. You can learn more about the Uniswap Grants Program (and maybe apply!).

Introduction to Markets

How Centralized Exchanges Work

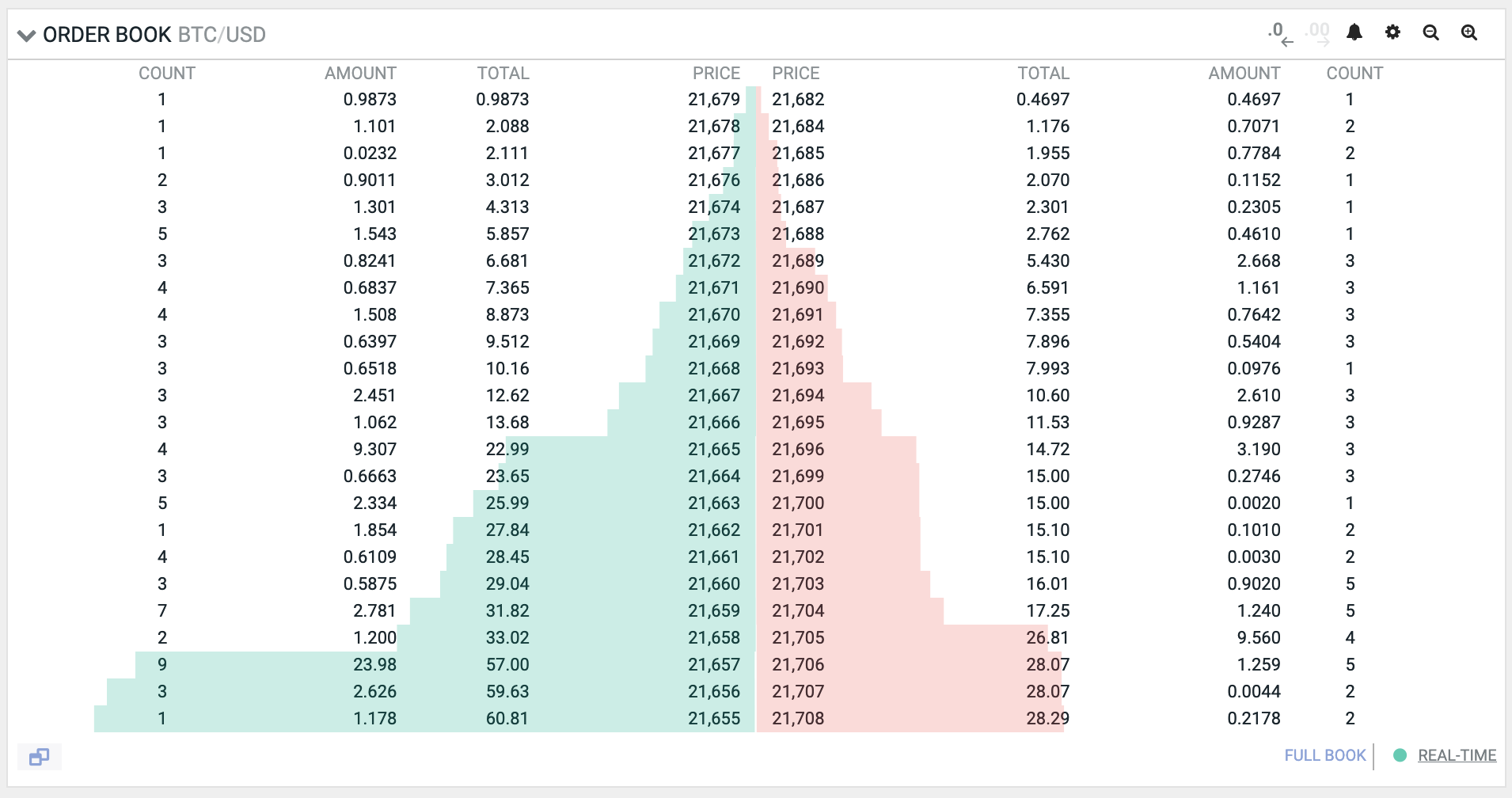

In this book, we’ll build a decentralized exchange (DEX) that will run on Ethereum. There are multiple approaches to how an exchange can be designed. All centralized exchanges have an order book at their core. An order book is just a journal that stores all the sell and buy orders that traders want to make. Each order in this book contains a price the order must be executed at and the amount that must be bought or sold.

For trading to happen, there must exist liquidity, which is simply the availability of assets on a market. If you want to buy a wardrobe but no one is selling one, there’s no liquidity. If you want to sell a wardrobe but no one wants to buy it, there’s liquidity but no buyers. If there’s no liquidity, there’s nothing to buy or sell.

On centralized exchanges, the order book is where liquidity is accumulated. If someone places a sell order, they provide liquidity to the market. If someone places a buy order, they expect the market to have liquidity, otherwise, no trade is possible.

When there’s no liquidity, but markets are still interested in trades, market makers come into play. A market maker is a firm or an individual who provides liquidity to markets, that is someone who has a lot of money and who buys different assets to sell them on exchanges. For this job market makers are paid by exchanges. Market makers make money by providing liquidity to exchanges.

How Decentralized Exchanges Work

Don’t be surprised, decentralized exchanges also need liquidity. And they also need someone who provides it to traders of a wide variety of assets. However, this process cannot be handled in a centralized way. A decentralized solution must be found. There are multiple decentralized solutions and some of them are implemented differently. Our focus will be on how Uniswap solves this problem.

Automated Market Makers

The evolution of on-chain markets brought us to the idea of Automated Market Makers (AMM). As the name implies, this algorithm works exactly like market makers but in an automated way. Moreover, it’s decentralized and permissionless, that is:

- it’s not governed by a single entity;

- all assets are not stored in one place;

- anyone can use it from anywhere.

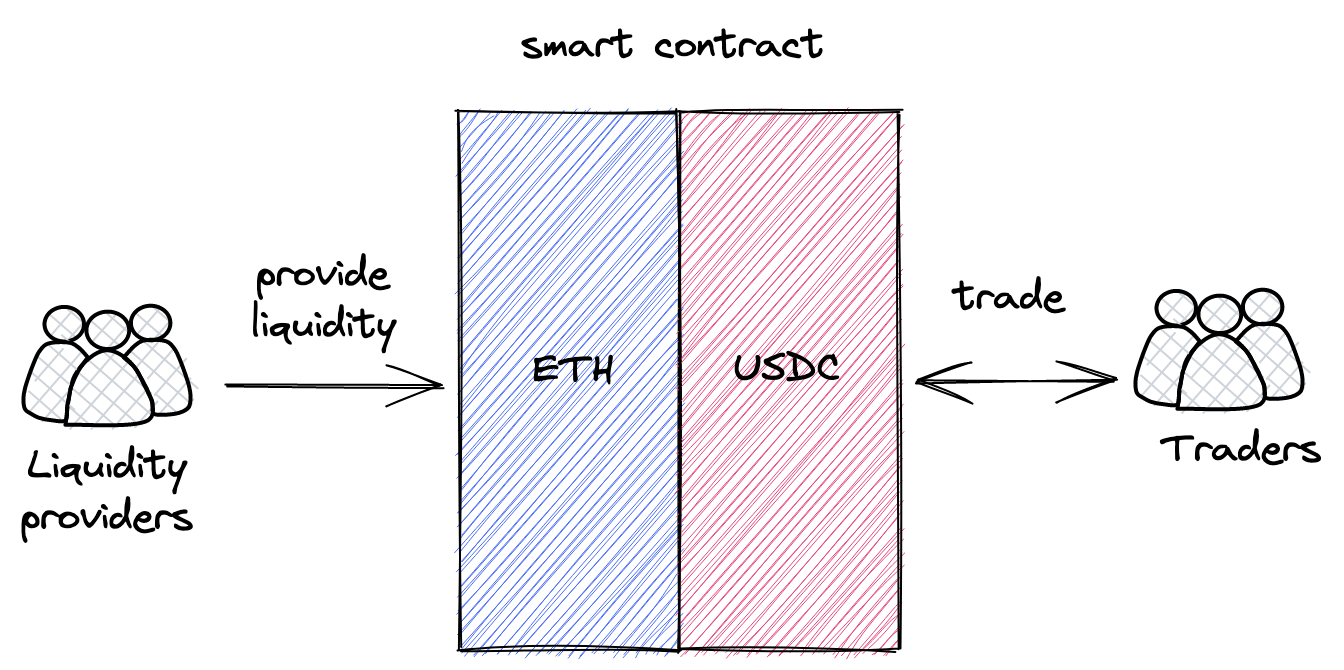

What Is an AMM?

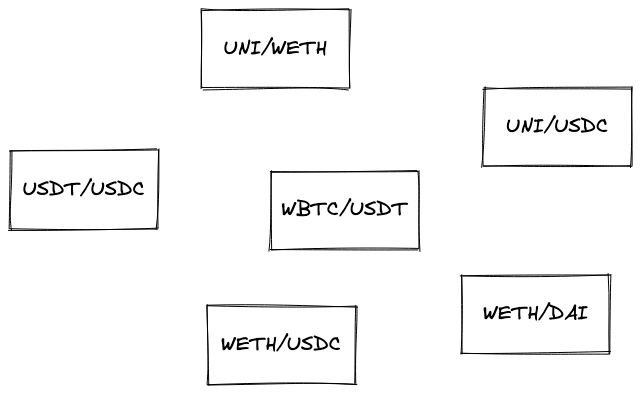

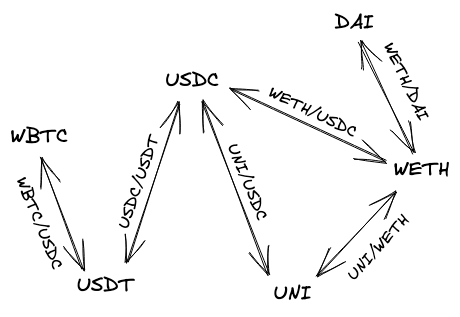

An AMM is a set of smart contracts that define how liquidity is managed. Each trading pair (e.g. ETH/USDC) is a separate contract that stores both ETH and USDC and that’s programmed to mediate trades: exchanging ETH for USDC and vice versa.

The core idea is pooling: each contract is a pool that stores liquidity and lets different users (including other smart contracts) trade in a permissionless way. There are two roles, liquidity providers and traders, and these roles interact with each other through pools of liquidity, and the way they can interact with pools is programmed and immutable.

What makes this approach different from centralized exchanges is that the smart contracts are fully automated and not managed by anyone. There are no managers, admins, privileged users, etc. There are only liquidity providers and traders (they can be the same people), and all the algorithms are programmed, immutable, and public.

Let’s now look closer at how Uniswap implements an AMM.

Please note that I use pool and pair terms interchangeably throughout the book because a Uniswap pool is a pair of two tokens.

If you have any questions, feel free to ask them in the GitHub Discussion of this milestone!

Constant Function Market Makers

This chapter retells the whitepaper of Uniswap V2. Understanding this math is crucial to build a Uniswap-like DEX, but it’s totally fine if you don’t understand everything at this stage.

As I mentioned in the previous section, there are different approaches to building AMM. We’ll be focusing on and building one specific type of AMM–Constant Function Market Maker. Don’t be scared by the long name! At its core is a very simple mathematical formula:

That’s it, this is the AMM.

and are pool contract reserves–the amounts of tokens it currently holds. k is just their product, actual value doesn’t matter.

Why are there only two reserves, x and y?

Each Uniswap pool can hold only two tokens. We use x and y to refer to reserves of one pool, where x is the reserve of the first token and y is the reserve of the other token, and the order doesn’t matter.

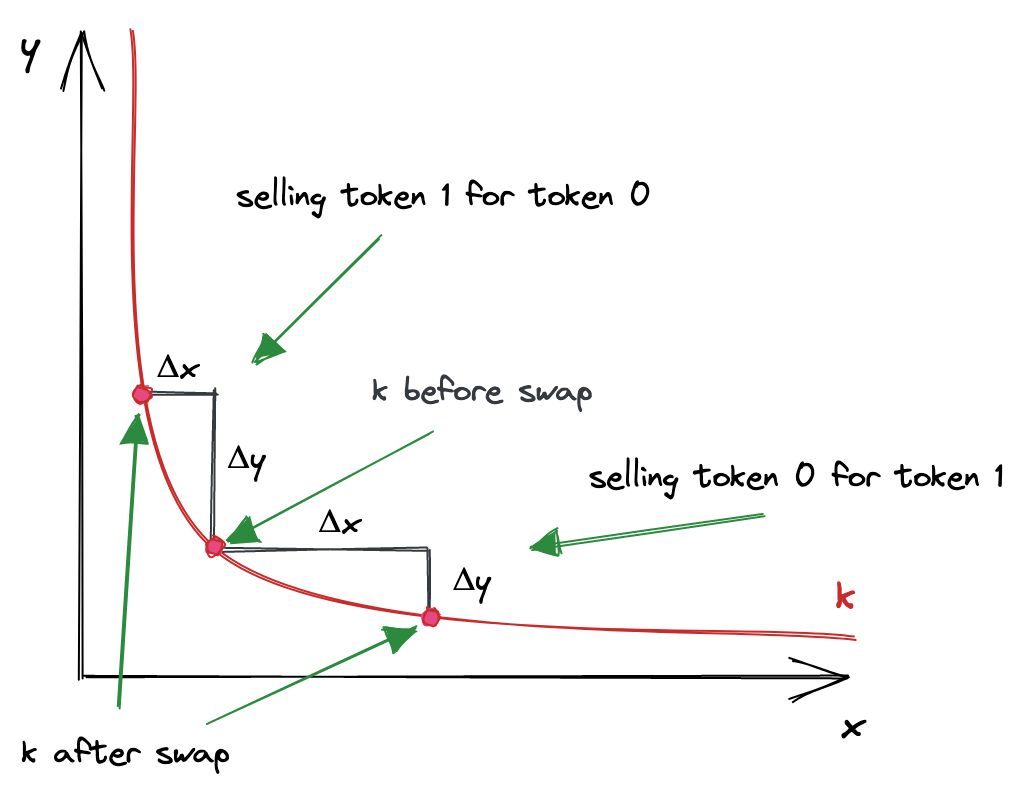

The constant function formula says: after each trade, k must remain unchanged. When traders make trades, they put some amount of one token into a pool (the token they want to sell) and remove some amount of the other token from the pool (the token they want to buy). This changes the reserves of the pool, and the constant function formula says that the product of reserves must not change. As we will see many times in this book, this simple requirement is the core algorithm of how Uniswap works.

The Trade Function

Now that we know what pools are, let’s write the formula of how trading happens in a pool:

- There’s a pool with some amount of token 0 () and some amount of token 1 ()

- When we buy token 1 for token 0, we give some amount of token 0 to the pool ().

- The pool gives us some amount of token 1 in exchange ().

- The pool also takes a small fee () from the amount of token 0 we gave.

- The reserve of token 0 changes (), and the reserve of token 1 changes as well ().

- The product of updated reserves must still equal .

We’ll use token 0 and token 1 notation for the tokens because this is how they’re referenced in the code. At this point, it doesn’t matter which of them is 0 and which is 1.

We’re basically giving a pool some amount of token 0 and getting some amount of token 1. The job of the pool is to give us a correct amount of token 1 calculated at a fair price. This leads us to the following conclusion: pools decide what trade prices are.

Pricing

How do we calculate the prices of tokens in a pool?

Since Uniswap pools are separate smart contracts, tokens in a pool are priced in terms of each other. For example: in a ETH/USDC pool, ETH is priced in terms of USDC, and USDC is priced in terms of ETH. If 1 ETH costs 1000 USDC, then 1 USDC costs 0.001 ETH. The same is true for any other pool, whether it’s a stablecoin pair or not (e.g. ETH/BTC).

In the real world, everything is priced based on the law of supply and demand. This also holds true for AMMs. We’ll put the demand part aside for now and focus on supply.

The prices of tokens in a pool are determined by the supply of the tokens, that is by the amounts of reserves of the tokens that the pool is holding. Token prices are simply relations of reserves:

Where and are prices of tokens in terms of the other token.

Such prices are called spot prices and they only reflect current market prices. However, the actual price of a trade is calculated differently. And this is where we need to bring the demand part back.

Concluding from the law of supply and demand, high demand increases the price–and this is a property we need to have in a permissionless system. We want the price to be high when demand is high, and we can use pool reserves to measure the demand: the more tokens you want to remove from a pool (relative to the pool’s reserves), the higher the impact of demand is.

Let’s return to the trade formula and look at it closer:

As you can see, we can derive and from it, which means we can calculate the output amount of a trade based on the input amount and vice versa:

In fact, these formulas free us from calculating prices! We can always find the output amount using the formula (when we want to sell a known amount of tokens) and we can always find the input amount using the formula (when we want to buy a known amount of tokens). Notice that each of these formulas is a relation of reserves ( or ) and they also take the trade amount ( in the former and in the latter) into consideration. These are the pricing functions that respect both supply and demand. And we don’t even need to calculate the prices!

Here’s how you can derive the above formulas from the trade function: And:

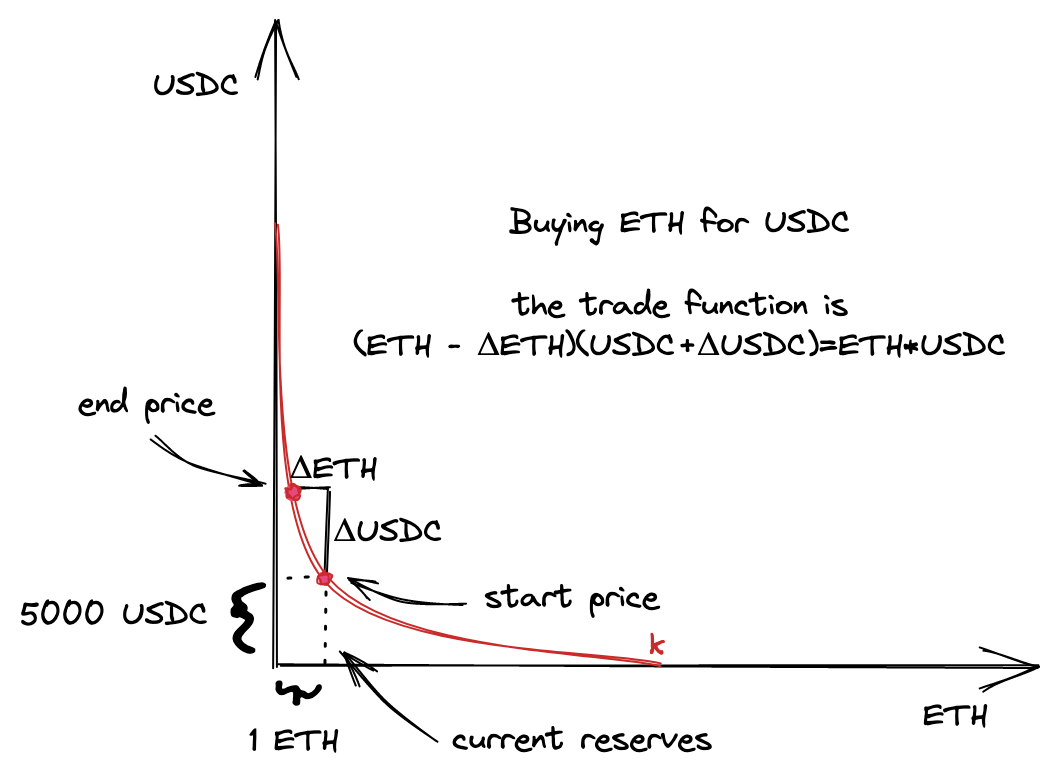

The Curve

The above calculations might seem too abstract and dry. Let’s visualize the constant product function to better understand how it works.

When plotted, the constant product function is a quadratic hyperbola:

Where axes are the pool reserves. Every trade starts at the point on the curve that corresponds to the current ratio of reserves. To calculate the output amount, we need to find a new point on the curve, which has the coordinate of , i.e. current reserve of token 0 + the amount we’re selling. The change in is the amount of token 1 we’ll get.

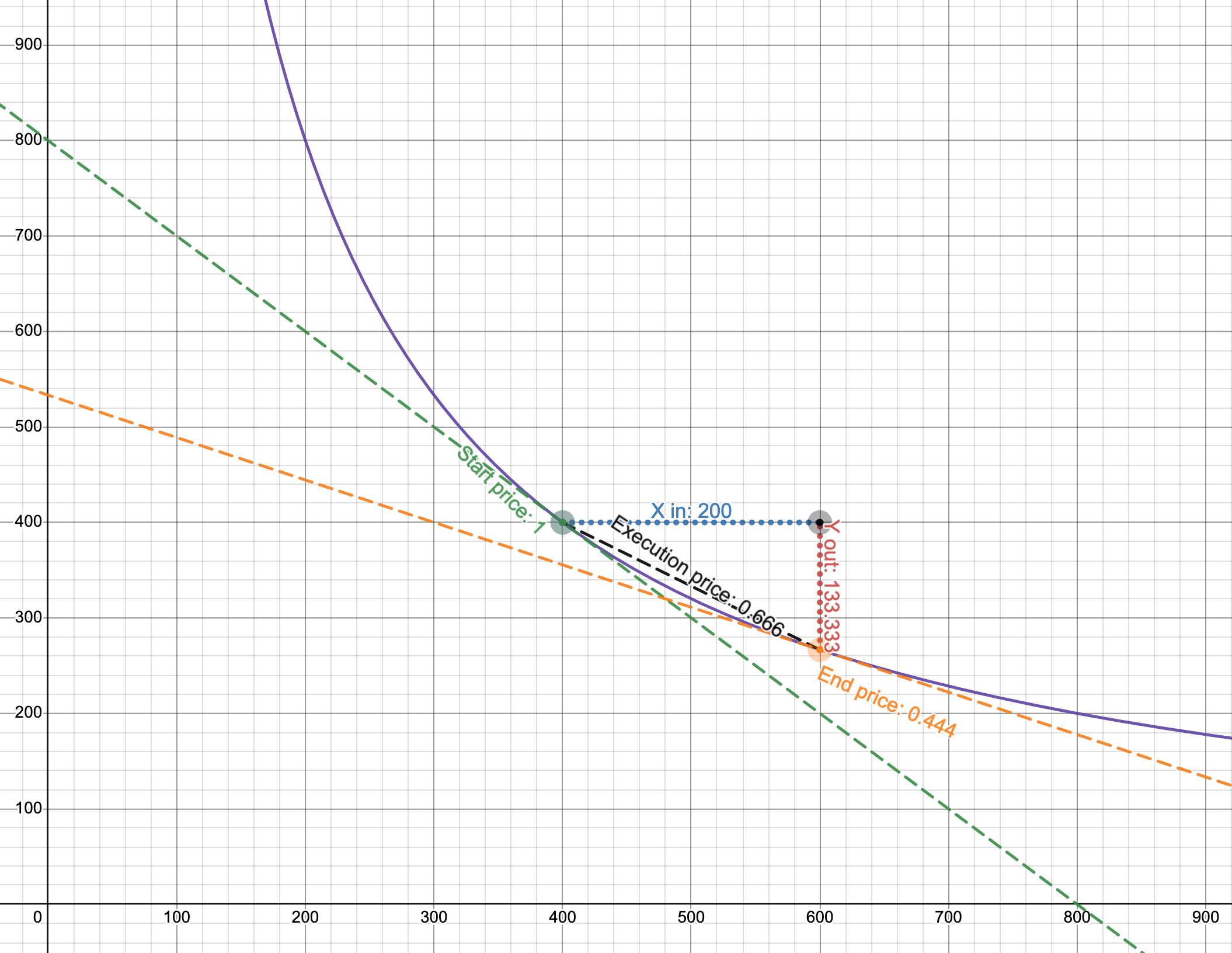

Let’s look at a concrete example:

- The purple line is the curve, and the axes are the reserves of a pool (notice that they’re equal at the start price).

- The start price is 1.

- We’re selling 200 of token 0. If we use only the start price, we expect to get 200 of token 1.

- However, the execution price is 0.666, so we get only 133.333 of token 1!

This example is from the Desmos chart made by Dan Robinson, one of the creators of Uniswap. To build a better intuition of how it works, try making up different scenarios and plotting them on the graph. Try different reserves, and see how the output amount changes when is small relative to .

As the legend goes, Uniswap was invented in Desmos.

I bet you’re wondering why using such a curve. It might seem like it punishes you for trading big amounts. This is true, and this is a desirable property! The law of supply and demand tells us that when demand is high (and supply is constant) the price is also high. And when demand is low, the price is also lower. This is how markets work. And, magically, the constant product function implements this mechanism! Demand is defined by the amount you want to buy, and supply is the pool reserves. When you want to buy a big amount relative to pool reserves the price is higher than when you want to buy a smaller amount. Such a simple formula guarantees such a powerful mechanism!

Even though Uniswap doesn’t calculate trade prices, we can still see them on the curve. Surprisingly, there are multiple prices when making a trade:

- Before a trade, there’s a spot price. It’s equal to the relation of reserves, or depending on the direction of the trade. This price is also the slope of the tangent line at the starting point.

- After a trade, there’s a new spot price, at a different point on the curve. And it’s the slope of the tangent line at this new point.

- The actual price of the trade is the slope of the line connecting the two points!

And that’s the whole math of Uniswap! Phew!

Well, this is the math of Uniswap V2, and we’re studying Uniswap V3. So in the next part, we’ll see how the mathematics of Uniswap V3 is different.

Introduction to Uniswap V3

This chapter retells the whitepaper of Uniswap V3. Again, it’s totally ok if you don’t understand all the concepts. They will be clearer when converted to code.

To better understand the innovations Uniswap V3 brings, let’s first look at the imperfections of Uniswap V2.

Uniswap V2 is a general exchange that implements one AMM algorithm. However, not all trading pairs are equal. Pairs can be grouped by price volatility:

- Tokens with medium and high price volatility. This group includes most tokens since most tokens don’t have their prices pegged to something and are subject to market fluctuations.

- Tokens with low volatility. This group includes pegged tokens, mainly stablecoins: USDC/USDT, USDC/DAI, USDT/DAI, etc. Also: ETH/stETH, ETH/rETH (variants of wrapped ETH).

These groups require different, let’s call them, pool configurations. The main difference is that pegged tokens require high liquidity to reduce the demand effect (we learned about it in the previous chapter) on big trades. The prices of USDC and USDT must stay close to 1, no matter how big the number of tokens we want to buy and sell. Since Uniswap V2’s general AMM algorithm is not very well suited for stablecoin trading, alternative AMMs (mainly Curve) were more popular for stablecoin trading.

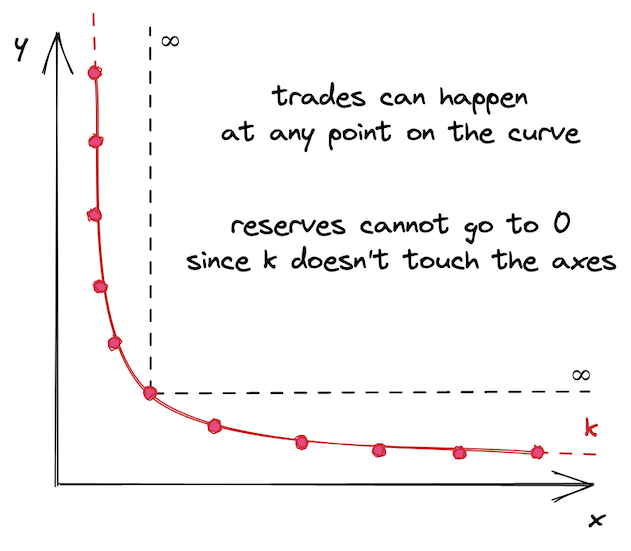

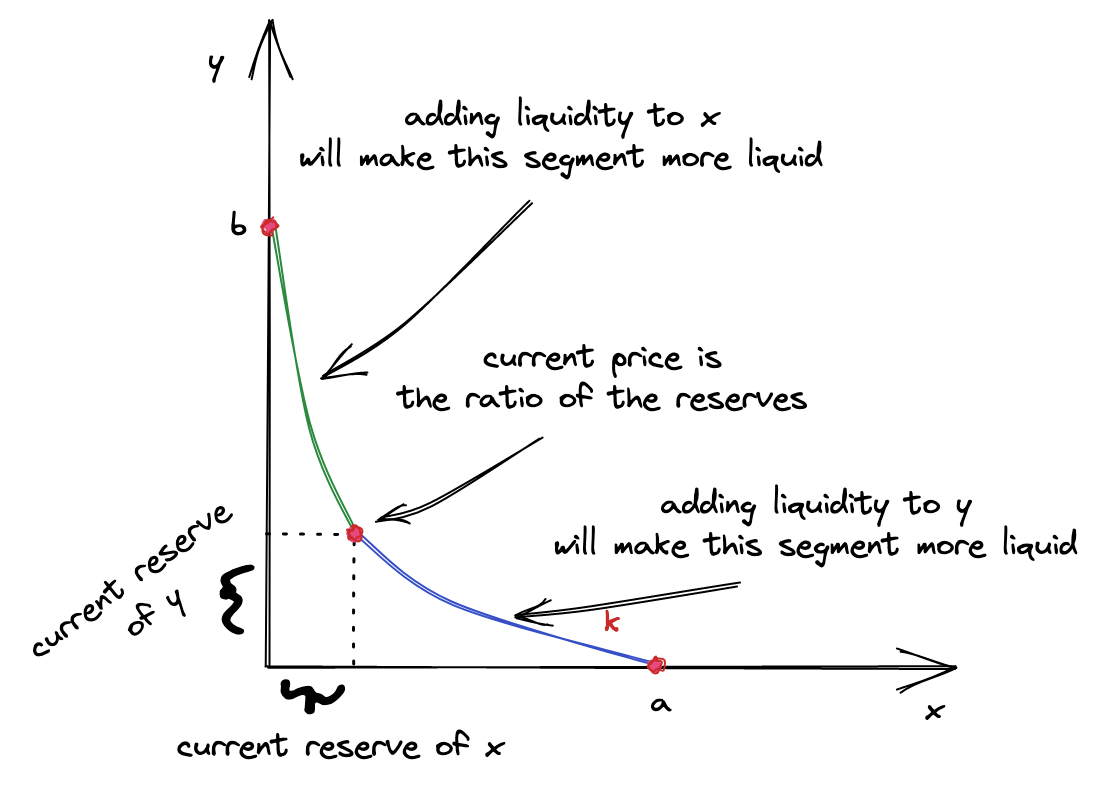

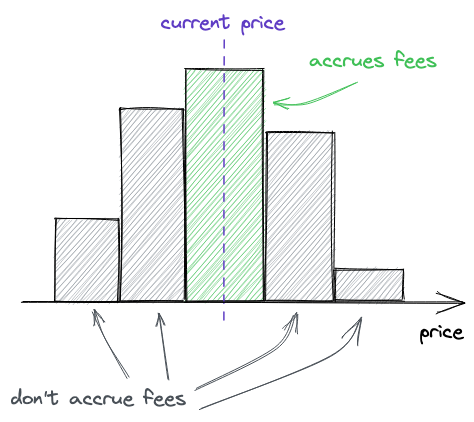

What caused this problem is that liquidity in Uniswap V2 pools is distributed infinitely–pool liquidity allows trades at any price, from 0 to infinity:

This might not seem like a bad thing, but this makes capital inefficient. Historical prices of an asset stay within some defined range, whether it’s narrow or wide. For example, the historical price range of ETH is from 4,800 (according to CoinMarketCap). Today (June 2022, 1 ETH costs $1,800), no one would buy 1 ether at $5000, so it makes no sense to provide liquidity at this price. Thus, it doesn’t make sense to provide liquidity in a price range that’s far away from the current price or that will never be reached.

However, we all believe in ETH reaching $10,000 one day.

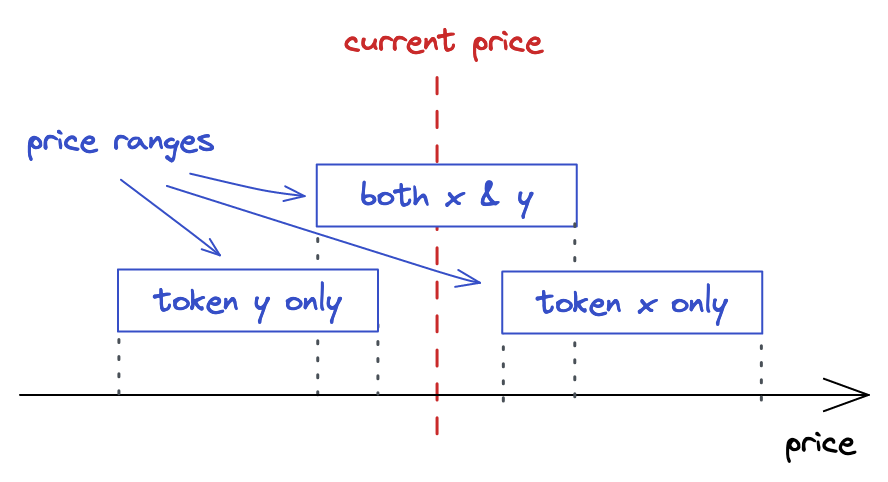

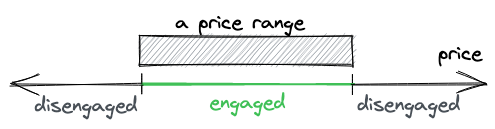

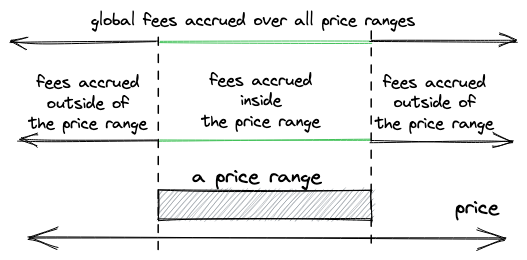

Concentrated Liquidity

Uniswap V3 introduces concentrated liquidity: liquidity providers can now choose the price range they want to provide liquidity into. This improves capital efficiency by allowing to put more liquidity into a narrow price range, which makes Uniswap more diverse: it can now have pools configured for pairs with different volatility. This is how V3 improves V2.

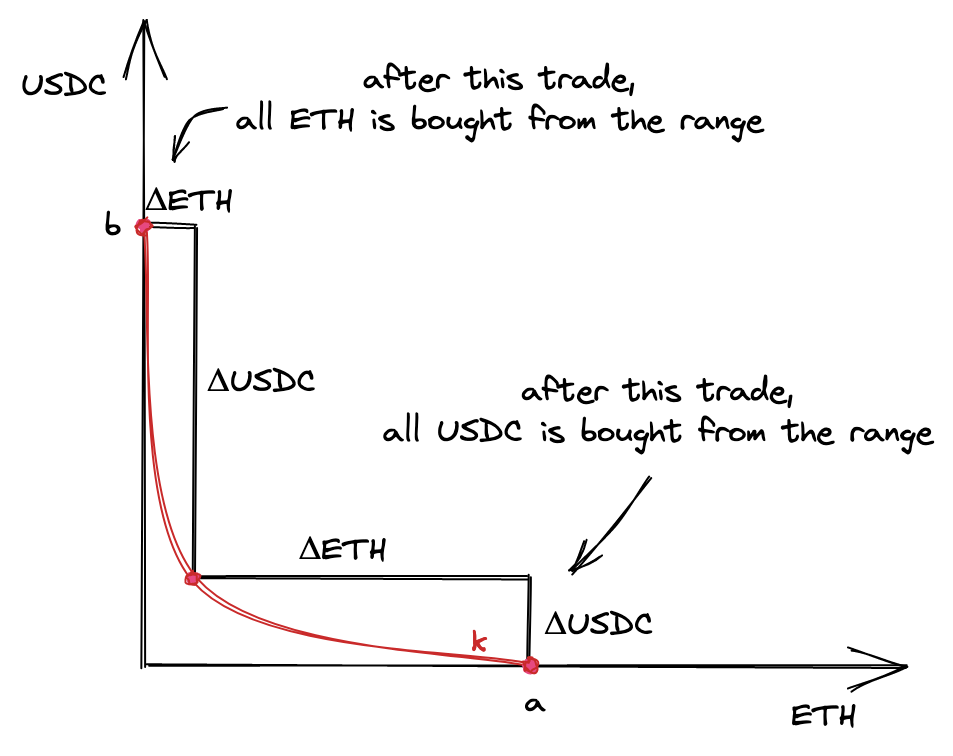

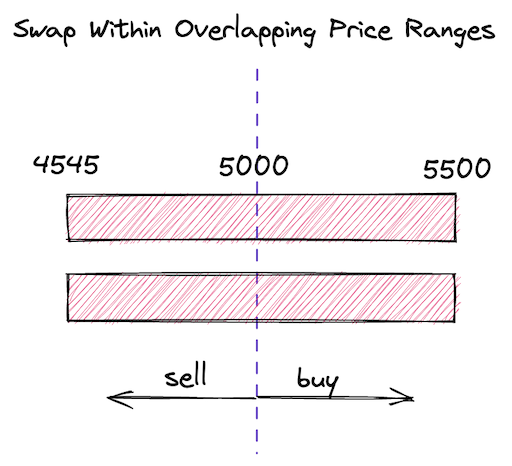

In a nutshell, a Uniswap V3 pair is many small Uniswap V2 pairs. The main difference between V2 and V3 is that, in V3, there are many price ranges in one pair. And each of these shorter price ranges has finite reserves. The entire price range from 0 to infinite is split into shorter price ranges, with each of them having its own amount of liquidity. But, what’s crucial is that within that shorter price range, it works exactly as Uniswap V2. This is why I say that a V3 pair is many small V2 pairs.

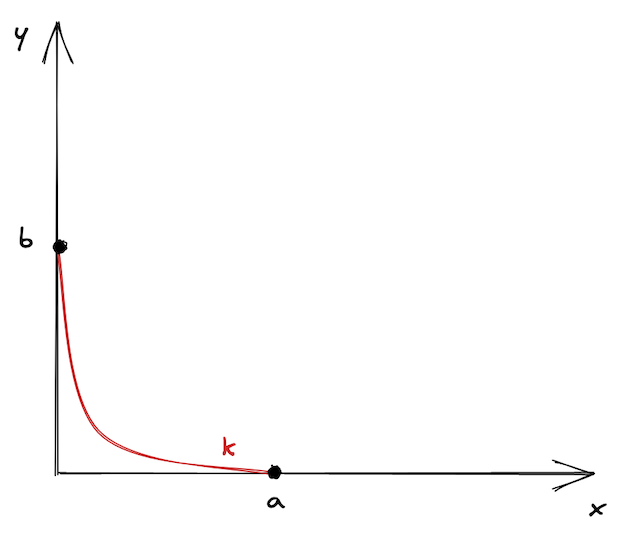

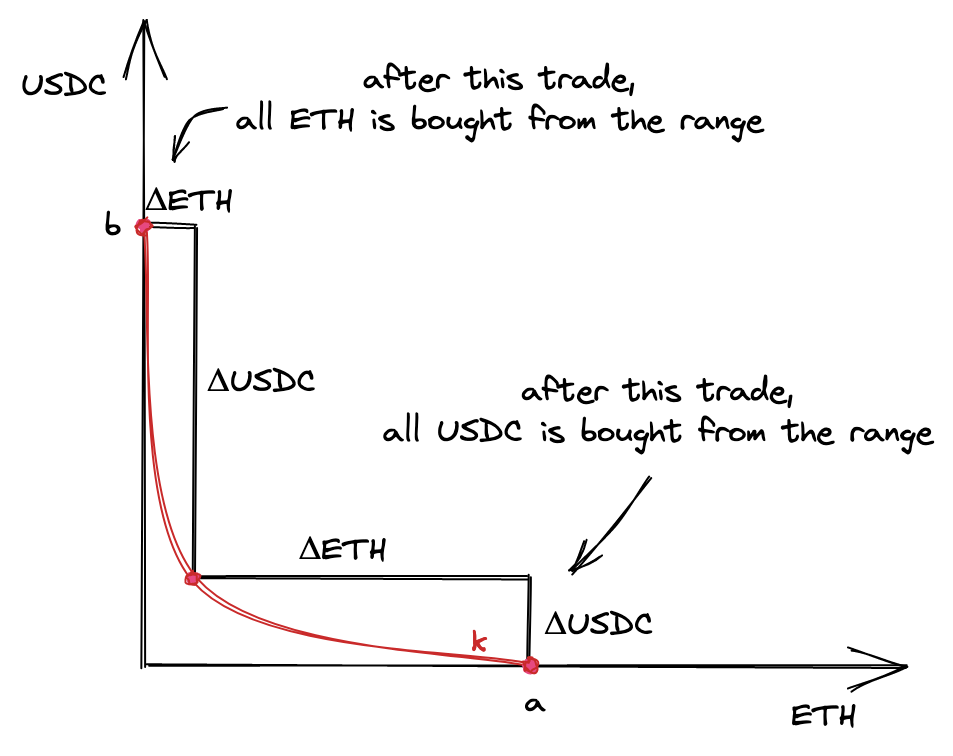

Now, let’s try to visualize it. What we’re saying is that we don’t want the curve to be infinite. We cut it at the points and and say that these are the boundaries of the curve. Moreover, we shift the curve so the boundaries lay on the axes. This is what we get:

It looks lonely, doesn’t it? This is why there are many price ranges in Uniswap V3–so they don’t feel lonely 🙂

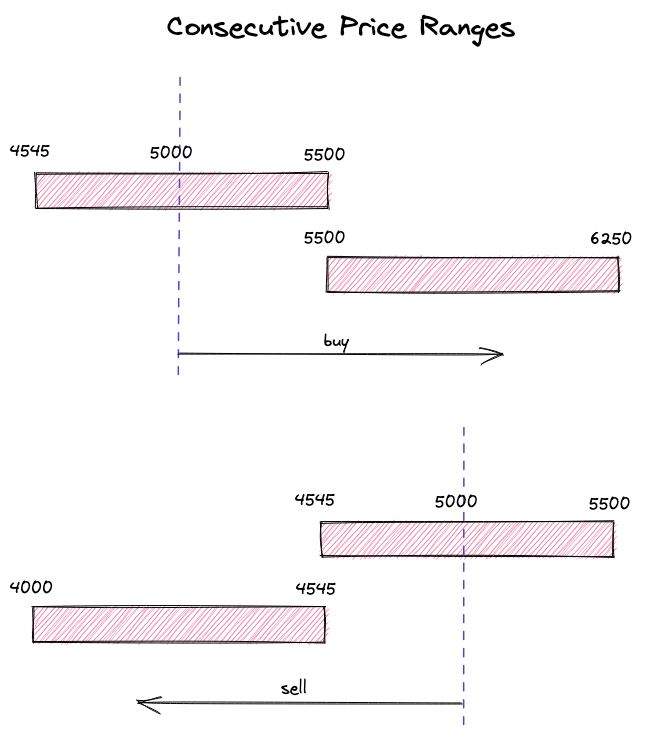

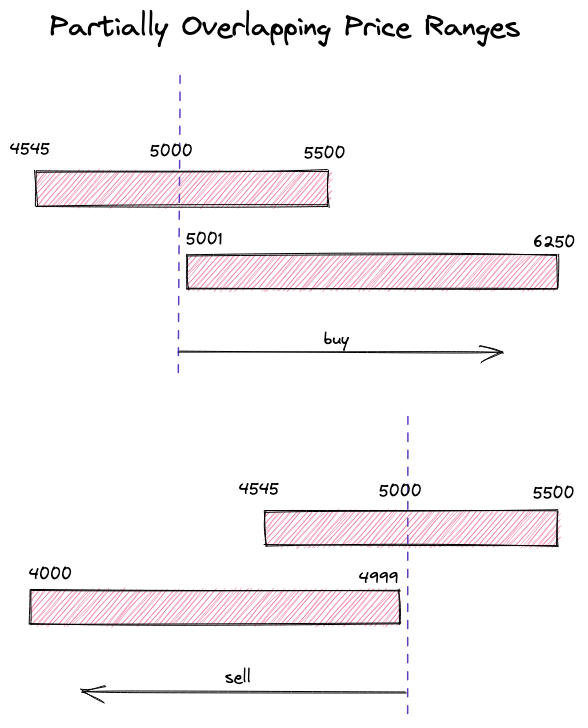

As we saw in the previous chapter, buying or selling tokens moves the price along the curve. A price range limits the movement of the price. When the price moves to either of the points, the pool becomes depleted: one of the token reserves will be 0, and buying this token won’t be possible.

On the chart above, let’s assume that the start price is at the middle of the curve. To get to the point , we need to buy all available and maximize in the range; to get to the point , we need to buy all available and maximize in the range. At these points, there’s only one token in the range!

Fun fact: this allows using Uniswap V3 price ranges as limit orders!

What happens when the current price range gets depleted during a trade? The price slips into the next price range. If the next price range doesn’t exist, the trade ends up partially fulfilled-we’ll see how this works later in the book.

This is how liquidity is spread in the USDC/ETH pool in production:

You can see that there’s a lot of liquidity around the current price but the further away from it the less liquidity there is–this is because liquidity providers strive to have higher efficiency of their capital. Also, the whole range is not infinite, its upper boundary is shown in the image.

The Mathematics of Uniswap V3

Mathematically, Uniswap V3 is based on V2: it uses the same formulas, but they’re… let’s call it augmented.

To handle transitioning between price ranges, simplify liquidity management, and avoid rounding errors, Uniswap V3 uses these new concepts:

is the amount of liquidity. Liquidity in a pool is the combination of token reserves (that is, two numbers). We know that their product is , and we can use this to derive the measure of liquidity, which is –a number that, when multiplied by itself, equals . is the geometric mean of and .

is the price of token 0 in terms of 1. Since token prices in a pool are reciprocals of each other, we can use only one of them in calculations (and by convention Uniswap V3 uses ). The price of token 1 in terms of token 0 is simply . Similarly, .

Why using instead of ? There are two reasons:

-

Square root calculation is not precise and causes rounding errors. Thus, it’s easier to store the square root without calculating it in the contracts (we will not store and in the contracts).

-

has an interesting connection to : is also the relation between the change in output amount and the change in .

Proof:

Pricing

Again, we don’t need to calculate actual prices–we can calculate the output amount right away. Also, since we’re not going to track and store and , our calculation will be based only on and .

From the above formula, we can find :

See the third step in the proof above.

As we discussed above, prices in a pool are reciprocals of each other. Thus, is:

and allow us to not store and update pool reserves. Also, we don’t need to calculate each time because we can always find and its reciprocal.

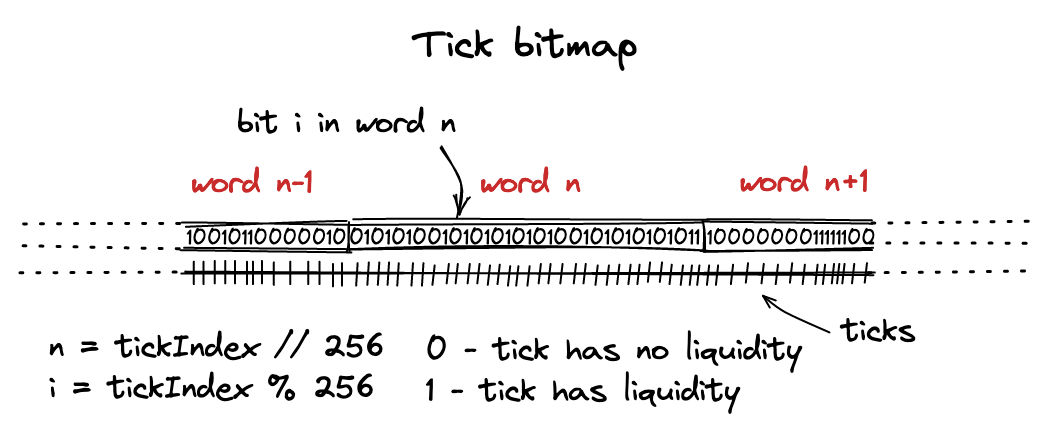

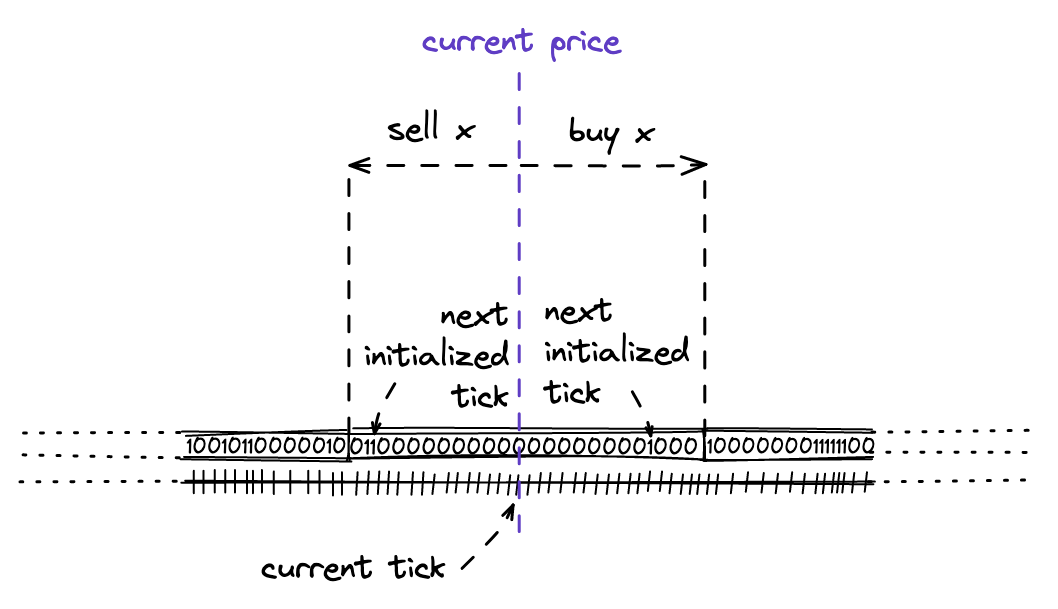

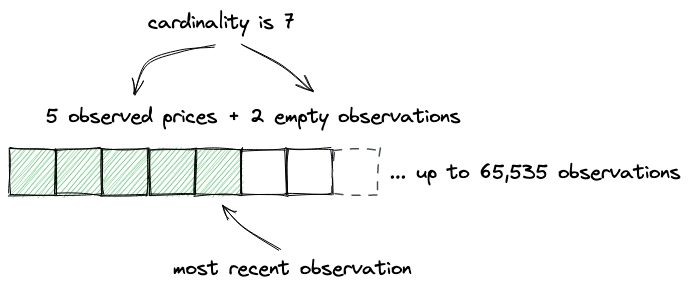

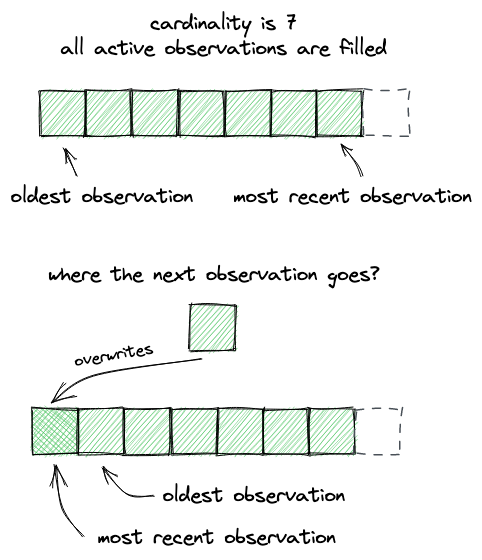

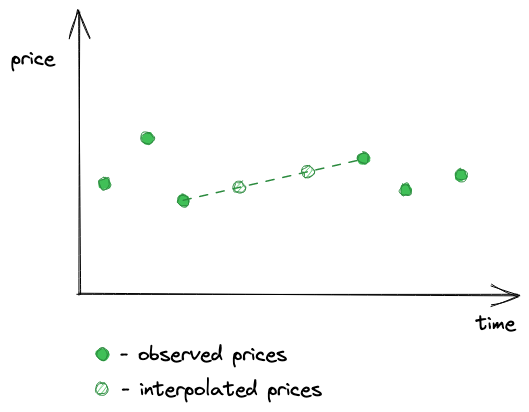

Ticks

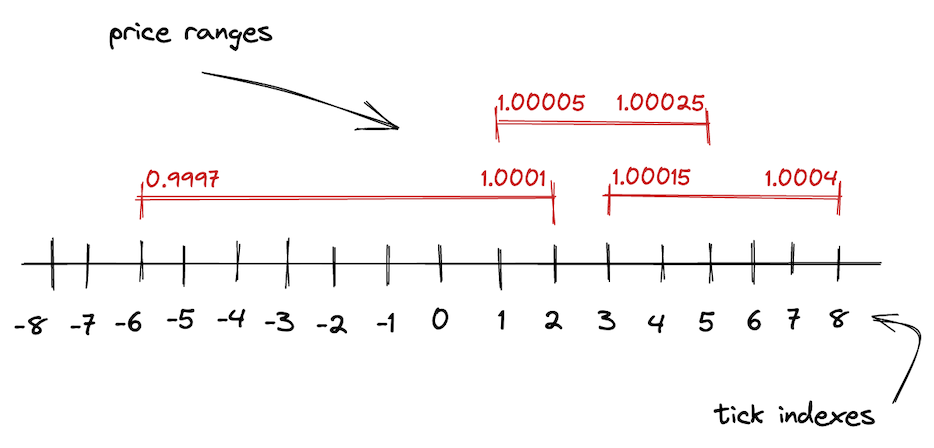

As we learned in this chapter, the infinite price range of V2 is split into shorter price ranges in V3. Each of these shorter price ranges is limited by boundaries–upper and lower points. To track the coordinates of these boundaries, Uniswap V3 uses ticks.

In V3, the entire price range is demarcated by evenly distributed discrete ticks. Each tick has an index and corresponds to a certain price:

Where is the price at tick . Taking powers of 1.0001 has a desirable property: the difference between two adjacent ticks is 0.01% or 1 basis point.

Basis point (1/100th of 1%, or 0.01%, or 0.0001) is a unit of measure of percentages in finance. You could’ve heard about the basis point when central banks announced changes in interest rates.

As we discussed above, Uniswap V3 stores , not . Thus, the formula is in fact:

So, we get values like: , , .

Ticks are integers that can be positive and negative and, of course, they’re not infinite. Uniswap V3 stores as a fixed point Q64.96 number, which is a rational number that uses 64 bits for the integer part and 96 bits for the fractional part. Thus, prices (equal to the square of ) are within the range: . And ticks are within the range:

For deeper dive into the math of Uniswap V3, I cannot but recommend this technical note by Atis Elsts.

Development Environment

We’re going to build two applications:

- An on-chain one: a set of smart contracts deployed on Ethereum.

- An off-chain one: a front-end application that will interact with the smart contracts.

While the front-end application development is part of this book, it won’t be our main focus. We will build it solely to demonstrate how smart contracts are integrated with front-end applications. Thus, the front-end application is optional, but I’ll still provide the code.

Quick Introduction to Ethereum

Ethereum is a blockchain that allows anyone to run applications on it. It might look like a cloud provider, but there are multiple differences:

- You don’t pay for hosting your application. But you pay for deployment.

- Your application is immutable. That is: you won’t be able to modify it after it’s deployed.

- Users will pay to use your application.

To better understand these moments, let’s see what Ethereum is made of.

At the core of Ethereum (and any other blockchain) is a database. The most valuable data in Ethereum’s database is the state of accounts. An account is an Ethereum address with associated data:

- Balance: account’s ether balance.

- Code: bytecode of the smart contract deployed at this address.

- Storage: space used by smart contracts to store data.

- Nonce: a serial integer that’s used to protect against replay attacks.

Ethereum’s main job is building and maintaining this data in a secure way that doesn’t allow unauthorized access.

Ethereum is also a network, a network of computers that build and maintain the state independently of each other. The main goal of the network is to decentralize access to the database: there must be no single authority that’s allowed to modify anything in the database unilaterally. This is achieved through consensus, which is a set of rules all the nodes in the network follow. If one party decides to abuse a rule, it’ll be excluded from the network.

Fun fact: blockchain can use MySQL! Nothing prevents this besides performance. In its turn, Ethereum uses LevelDB, a fast key-value database.

Every Ethereum node also runs EVM, Ethereum Virtual Machine. A virtual machine is a program that can run other programs, and EVM is a program that executes smart contracts. Users interact with contracts through transactions: besides simply sending ether, transactions can contain smart contract call data. It includes:

- An encoded contract function name.

- Function parameters.

Transactions are packed in blocks and blocks are then mined by miners. Each participant in the network can validate any transaction and any block.

In a sense, smart contracts are similar to JSON APIs but instead of endpoints you call smart contract functions and you provide function arguments. Similar to API backends, smart contracts execute programmed logic, which can optionally modify smart contract storage. Unlike JSON API, you need to send a transaction to mutate the blockchain state, and you’ll need to pay for each transaction you’re sending.

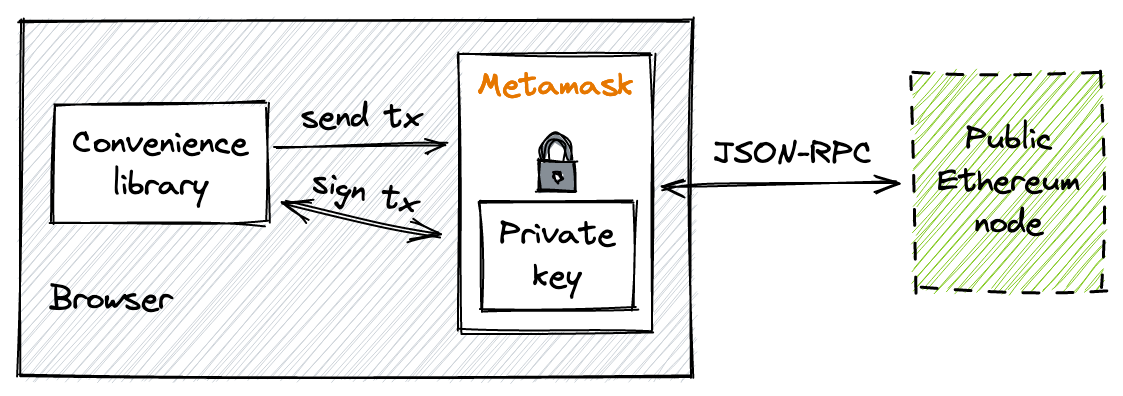

Finally, Ethereum nodes expose a JSON-RPC API. Through this API we can interact with a node to: get account balance, estimate gas costs, get blocks and transactions, send transactions, and execute contract calls without sending transactions (this is used to read data from smart contracts). Here you can find the full list of available endpoints.

Transactions are also sent through the JSON-RPC API, see eth_sendTransaction.

Local Development Environment

Multiple smart contract development environments are used today:

Truffle is the oldest of the three and is the least popular of them. Hardhat is its improved descendant and is the most widely used tool. Foundry is the new kid on the block, which brings a different view on testing.

While HardHat is still a popular solution, more and more projects are switching to Foundry. And there are multiple reasons for that:

- With Foundry, we can write tests in Solidity. This is much more convenient because we don’t need to jump between JavaScript (Truffle and HardHat use JS for tests and automation) and Solidity during development. Writing tests in Solidity is much more convenient because you have all the native features (e.g. you don’t need a special type for big numbers and you don’t need to convert between strings and BigNumber).

- Foundry doesn’t run a node during testing. This makes testing and iterating on features much faster! Truffle and HardHat start a node whenever you run tests; Foundry executes tests on an internal EVM.

That being said, we’ll use Foundry as our main smart contract development and testing tool.

Foundry

Foundry is a set of tools for Ethereum applications development. Specifically, we’re going to use:

- Forge, a testing framework for Solidity.

- Anvil, a local Ethereum node designed for development with Forge. We’ll use it to deploy our contracts to a local node and connect to it through the front-end app.

- Cast, a CLI tool with a ton of helpful features.

Forge makes smart contracts developer’s life so much easier. With Forge, we don’t need to run a local node to test contracts. Instead, Forge runs tests on its internal EVM, which is much faster and doesn’t require sending transactions and mining blocks.

Forge lets us write tests in Solidity! Forge also makes it easier to simulate blockchain state: we can easily fake our ether or token balance, execute contracts from other addresses, deploy any contracts at any address, etc.

However, we’ll still need a local node to deploy our contract to. For that, we’ll use Anvil. Front-end applications use JavaScript Web3 libraries to interact with Ethereum nodes (to send transactions, query state, estimate transaction gas cost, etc.)–this is why we’ll need to run a local node.

Ethers.js

Ethers.js is a set of Ethereum utilities written in JavaScript. This is one of the two (the other one is web3.js) most popular JavaScript libraries used in decentralized applications development. These libraries allow us to interact with an Ethereum node via the JSON-API, and they come with multiple utility functions that make the developer’s life easier.

MetaMask

MetaMask is an Ethereum wallet in your browser. It’s a browser extension that creates and securely stores private keys. MetaMask is the main Ethereum wallet application used by millions of users. We’ll use it to sign transactions that we’ll send to our local node.

React

React is a well-known JavaScript library for building front-end applications. You don’t need to know React, I’ll provide a template application.

Setting up the Project

To set up the project, create a new folder and run forge init in it:

$ mkdir uniswapv3clone

$ cd uniswapv3clone

$ forge init

If you’re using Visual Studio Code, add

--vscodeflag toforge init:forge init --vscode. Forge will initialize the project with VSCode-specific settings.

Forge will create sample contracts in the src, test, and script folders–these can be removed.

To set up the front-end application:

$ npx create-react-app ui

It’s located in a subfolder so there’s no conflict between folder names.

What We Will Build

The goal of the book is to build a clone of Uniswap V3. However, we won’t build an exact copy. The main reason is that Uniswap is a big project with many nuances and auxiliary mechanics–breaking down all of them would bloat the book and make it harder for readers to finish it. Instead, we’ll build the core of Uniswap, its hardest and most important mechanisms. This includes liquidity management, swapping, fees, a periphery contract, a quoting contract, and an NFT contract. After that, I’m sure, you’ll be able to read the source code of Uniswap V3 and understand all the mechanics that were left outside of the scope of this book.

Smart Contracts

After finishing the book, you’ll have these contracts implemented:

UniswapV3Pool–the core pool contract that implements liquidity management and swapping. This contract is very close to the original one, however, some implementation details are different and something is missed for simplicity. For example, our implementation will only handle “exact input” swaps, that is swaps with known input amounts. The original implementation also supports swaps with known output amounts (i.e. when you want to buy a certain amount of tokens).UniswapV3Factory–the registry contract that deploys new pools and keeps a record of all deployed pools. This one is mostly identical to the original one besides the ability to change owner and fees.UniswapV3Manager–a periphery contract that makes it easier to interact with the pool contract. This is a very simplified implementation of SwapRouter. Again, as you can see, I don’t distinguish “exact input” and “exact output” swaps and implement only the former ones.UniswapV3Quoteris a cool contract that allows calculating swap prices on-chain. This is a minimal copy of both Quoter and QuoterV2. Again, only “exact input” swaps are supported.UniswapV3NFTManagerallows turning liquidity positions into NFTs. This is a simplified implementation of NonfungiblePositionManager.

Front-end Application

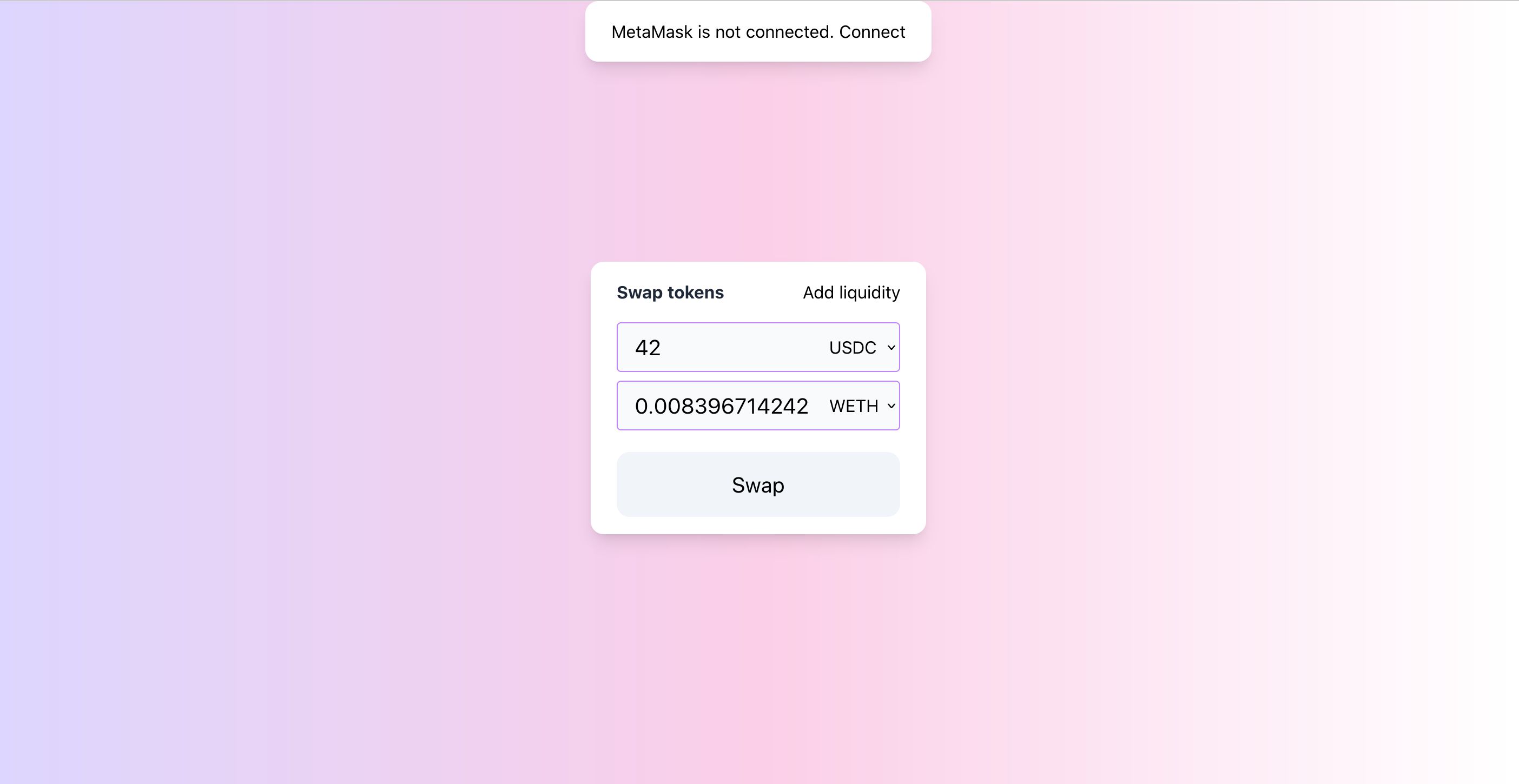

For this book, I also built a simplified clone of the Uniswap UI. This is a very dumb clone, and my React and front-end skills are very poor, but it demonstrates how a front-end application can interact with smart contracts using Ethers.js and MetaMask.

Introduction

In this milestone, we’ll build a pool contract that can receive liquidity from users and make swaps within a price range. To keep it as simple as possible, we’ll provide liquidity only in one price range and we’ll allow to make swaps only in one direction. Also, we’ll calculate all the required math manually to get better intuition before starting to use mathematical libs in Solidity.

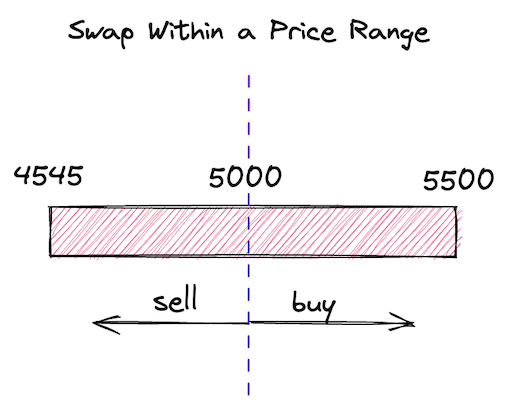

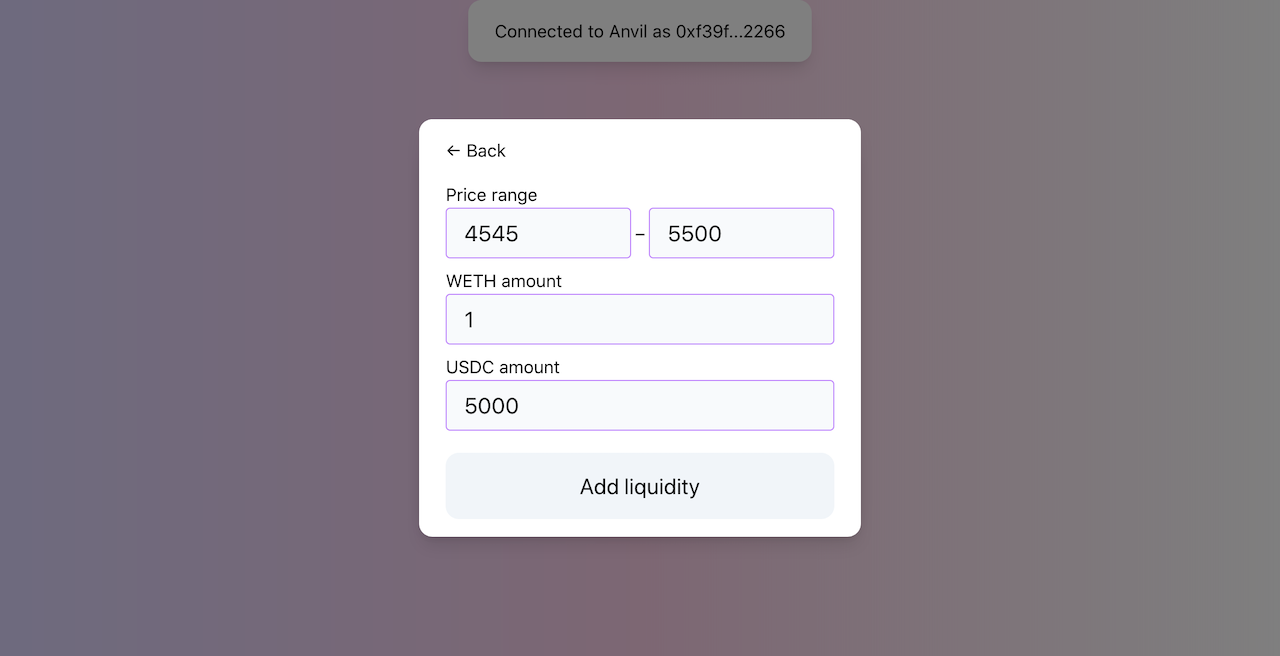

Let’s model the situation we’ll build:

- There will be an ETH/USDC pool contract. ETH will be the \(x\) reserve, and USDC will be the \(y\) reserve.

- We’ll set the current price to 5000 USDC per 1 ETH.

- The range we’ll provide liquidity into is 4545-5500 USDC per 1 ETH.

- We’ll buy some ETH from the pool. At this point, since we have only one price range, we want the price of the trade to stay within the price range.

Visually, this model looks like this:

Before getting to the code, let’s figure out the math and calculate all the parameters of the model. To keep things simple, I’ll do math calculations in Python before implementing them in Solidity. This will allow us to focus on the math without diving into the nuances of math in Solidity. This also means that, in smart contracts, we’ll hardcode all the amounts. This will allow us to start with a simple minimal viable product.

For your convenience, I put all the Python calculations in unimath.py.

You’ll find the complete code of this milestone in this Github branch.

If you have any questions, feel free to ask them in the GitHub Discussion of this milestone!

Calculating liquidity

Trading is not possible without liquidity, and to make our first swap we need to put some liquidity into the pool contract. Here’s what we need to know to add liquidity to the pool contract:

- A price range. As a liquidity provider, we want to provide liquidity at a specific price range, and it’ll only be used in this range.

- Amount of liquidity, which is the amounts of two tokens. We’ll need to transfer these amounts to the pool contract.

Here, we’re going to calculate these manually, but, in a later chapter, a contract will do this for us. Let’s begin with a price range.

Price Range Calculation

Recall that, in Uniswap V3, the entire price range is demarcated into ticks: each tick corresponds to a price and has an index. In our first pool implementation, we’re going to buy ETH for USDC at the price of $5000 per 1 ETH. Buying ETH will remove some amount of it from the pool and will push the price slightly above $5000. We want to provide liquidity at a range that includes this price. And we want to be sure that the final price will stay within this range (we’ll do multi-range swaps in a later milestone).

We’ll need to find three ticks:

- The current tick will correspond to the current price (5000 USDC for 1 ETH).

- The lower and upper bounds of the price range we’re providing liquidity into. Let the lower price be $4545 and the upper price be $5500.

From the theoretical introduction, we know that:

Since we’ve agreed to use ETH as the reserve and USDC as the reserve, the prices at each of the ticks are:

Where is the current price, is the lower bound of the range, and is the upper bound of the range.

Now, we can find corresponding ticks. We know that prices and ticks are connected via this formula:

Thus, we can find tick via:

The square roots in this formula cancel out, but since we’re working with we need to preserve them.

Let’s find the ticks:

- Current tick:

- Lower tick:

- Upper tick:

To calculate these, I used Python:

import math def price_to_tick(p): return math.floor(math.log(p, 1.0001)) price_to_tick(5000) > 85176

That’s it for price range calculation!

Last thing to note here is that Uniswap uses Q64.96 number to store . This is a fixed-point number that has 64 bits for the integer part and 96 bits for the fractional part. In our above calculations, prices are floating point numbers: 70.71, 67.42, and 74.16. We need to convert them to Q64.96. Luckily, this is simple: we need to multiply the numbers by (Q-number is a binary fixed-point number, so we need to multiply our decimals numbers by the base of Q64.96, which is ). We’ll get:

In Python:

q96 = 2**96 def price_to_sqrtp(p): return int(math.sqrt(p) * q96) price_to_sqrtp(5000) > 5602277097478614198912276234240Notice that we’re multiplying before converting to an integer. Otherwise, we’ll lose precision.

Token Amounts Calculation

The next step is to decide how many tokens we want to deposit into the pool. The answer is as many as we want. The amounts are not strictly defined, we can deposit as much as it is enough to buy a small amount of ETH without making the current price leave the price range we put liquidity into. During development and testing we’ll be able to mint any amount of tokens, so getting the amounts we want is not a problem.

For our first swap, let’s deposit 1 ETH and 5000 USDC.

Recall that the proportion of current pool reserves tells the current spot price. So if we want to put more tokens into the pool and keep the same price, the amounts must be proportional, e.g.: 2 ETH and 10,000 USDC; 10 ETH and 50,000 USDC, etc.

Liquidity Amount Calculation

Next, we need to calculate based on the amounts we’ll deposit. This is a tricky part, so hold tight!

From the theoretical introduction, you remember that:

However, this formula is for the infinite curve 🙂 But we want to put liquidity into a limited price range, which is just a segment of that infinite curve. We need to calculate specifically for the price range we’re going to deposit liquidity into. We need some more advanced calculations.

To calculate for a price range, let’s look at one interesting fact we have discussed earlier: price ranges can be depleted. It’s possible to buy the entire amount of one token from a price range and leave the pool with only the other token.

At the points and , there’s only one token in the range: ETH at the point and USDC at the point .

That being said, we want to find an that will allow the price to move to either of the points. We want enough liquidity for the price to reach either of the boundaries of a price range. Thus, we want to be calculated based on the maximum amounts of and .

Now, let’s see what the prices are at the edges. When ETH is bought from a pool, the price is growing; when USDC is bought, the price is falling. Recall that the price is . So, at point , the price is the lowest of the range; at point , the price is the highest.

In fact, prices are not defined at these points because there’s only one reserve in the pool, but what we need to understand here is that the price around the point is higher than the start price, and the price at the point is lower than the start price.

Now, break the curve from the image above into two segments: one to the left of the start point and one to the right of the start point. We’re going to calculate two ’s, one for each of the segments. Why? Because each of the two tokens of a pool contributes to either of the segments: the left segment is made entirely of token , and the right segment is made entirely of token . This comes from the fact that, during swapping, the price moves in either direction: it’s either growing or falling. For the price to move, only either of the tokens is needed:

- when the price is growing, only token is needed for the swap (we’re buying token , so we want to take only token from the pool);

- when the price is falling, only token is needed for the swap.

Thus, the liquidity in the segment of the curve to the left of the current price consists only of token and is calculated only from the amount of token provided. Similarly, the liquidity in the segment of the curve to the right of the current price consists only of token and is calculated only from the amount of token provided.

This is why, when providing liquidity, we calculate two ’s and pick one of them. Which one? The smaller one. Why? Because the bigger one already includes the smaller one! We want the new liquidity to be distributed evenly along the curve, thus we want to add the same to the left and to the right of the current price. If we pick the bigger one, the user would need to provide more liquidity to compensate for the shortage in the smaller one. This is doable, of course, but this would make the smart contract more complex.

What happens with the remainder of the bigger ? Well, nothing. After picking the smaller we can simply convert it to a smaller amount of the token that resulted in the bigger –this will adjust it down. After that, we’ll have token amounts that will result in the same .

The final detail I need to focus your attention on here is: new liquidity must not change the current price. That is, it must be proportional to the current proportion of the reserves. And this is why the two ’s can be different–when the proportion is not preserved. And we pick the small to reestablish the proportion.

I hope this will make more sense after we implement this in code! Now, let’s look at the formulas.

Let’s recall how and are calculated:

We can expand these formulas by replacing the delta P’s with actual prices (we know them from the above):

is the price at the point , is the price at the point , and is the current price (see the above chart). Notice that, since the price is calculated as (i.e. it’s the price of in terms of ), the price at point is higher than the current price and the price at . The price at is the lowest of the three.

Let’s find the from the first formula:

And from the second formula:

So, these are our two ’s, one for each of the segments:

Now, let’s plug the prices we calculated earlier into them:

After converting to Q64.96, we get:

And for the other :

Of these two, we’ll pick the smaller one.

In Python:

sqrtp_low = price_to_sqrtp(4545) sqrtp_cur = price_to_sqrtp(5000) sqrtp_upp = price_to_sqrtp(5500) def liquidity0(amount, pa, pb): if pa > pb: pa, pb = pb, pa return (amount * (pa * pb) / q96) / (pb - pa) def liquidity1(amount, pa, pb): if pa > pb: pa, pb = pb, pa return amount * q96 / (pb - pa) eth = 10**18 amount_eth = 1 * eth amount_usdc = 5000 * eth liq0 = liquidity0(amount_eth, sqrtp_cur, sqrtp_upp) liq1 = liquidity1(amount_usdc, sqrtp_cur, sqrtp_low) liq = int(min(liq0, liq1)) > 1517882343751509868544

Token Amounts Calculation, Again

Since we choose the amounts we’re going to deposit, the amounts can be wrong. We cannot deposit any amounts at any price range; the liquidity amount needs to be distributed evenly along the curve of the price range we’re depositing into. Thus, even though users choose amounts, the contract needs to re-calculate them, and actual amounts will be slightly different (at least because of rounding).

Luckily, we already know the formulas:

In Python:

def calc_amount0(liq, pa, pb): if pa > pb: pa, pb = pb, pa return int(liq * q96 * (pb - pa) / pa / pb) def calc_amount1(liq, pa, pb): if pa > pb: pa, pb = pb, pa return int(liq * (pb - pa) / q96) amount0 = calc_amount0(liq, sqrtp_upp, sqrtp_cur) amount1 = calc_amount1(liq, sqrtp_low, sqrtp_cur) (amount0, amount1) > (998976618347425408, 5000000000000000000000)As you can see, the numbers are close to the amounts we want to provide, but ETH is slightly smaller.

Hint: use

cast --from-wei AMOUNTto convert from wei to ether, e.g.:

cast --from-wei 998976618347425280will give you0.998976618347425280.

Providing Liquidity

Enough of theory, let’s start coding!

Create a new folder (mine is called uniswapv3-code), and run forge init --vscode in it–this will initialize a Forge project. The --vscode flag tells Forge to configure the Solidity extension for Forge projects.

Next, remove the default contract and its test:

script/Contract.s.solsrc/Contract.soltest/Contract.t.sol

And that’s it! Let’s create our first contract!

Pool Contract

As you’ve learned from the introduction, Uniswap deploys multiple Pool contracts, each of which is an exchange market of a pair of tokens. Uniswap groups all its contracts into two categories:

- core contracts,

- and periphery contracts.

Core contracts are, as the name implies, contracts that implement core logic. These are minimal, user-unfriendly, low-level contracts. Their purpose is to do one thing and do it as reliably and securely as possible. In Uniswap V3, there are 2 such contracts:

- Pool contract, which implements the core logic of a decentralized exchange.

- Factory contract, which serves as a registry of Pool contracts and a contract that makes deployment of pools easier.

We’ll begin with the pool contract, which implements 99% of the core functionality of Uniswap.

Create src/UniswapV3Pool.sol:

pragma solidity ^0.8.14;

contract UniswapV3Pool {}

Let’s think about what data the contract will store:

- Since every pool contract is an exchange market of two tokens, we need to track the two token addresses. These addresses will be static, set once and forever during pool deployment (thus, they will be immutable).

- Each pool contract is a set of liquidity positions. We’ll store them in a mapping, where keys are unique position identifiers and values are structs holding information about positions.

- Each pool contract will also need to maintain a ticks registry–this will be a mapping with keys being tick indexes and values being structs storing information about ticks.

- Since the tick range is limited, we need to store the limits in the contract, as constants.

- Recall that pool contracts store the amount of liquidity, . So we’ll need to have a variable for it.

- Finally, we need to track the current price and the related tick. We’ll store them in one storage slot to optimize gas consumption: these variables will be often read and written together, so it makes sense to benefit from the state variables packing feature of Solidity.

All in all, this is what we begin with:

// src/lib/Tick.sol

library Tick {

struct Info {

bool initialized;

uint128 liquidity;

}

...

}

// src/lib/Position.sol

library Position {

struct Info {

uint128 liquidity;

}

...

}

// src/UniswapV3Pool.sol

contract UniswapV3Pool {

using Tick for mapping(int24 => Tick.Info);

using Position for mapping(bytes32 => Position.Info);

using Position for Position.Info;

int24 internal constant MIN_TICK = -887272;

int24 internal constant MAX_TICK = -MIN_TICK;

// Pool tokens, immutable

address public immutable token0;

address public immutable token1;

// Packing variables that are read together

struct Slot0 {

// Current sqrt(P)

uint160 sqrtPriceX96;

// Current tick

int24 tick;

}

Slot0 public slot0;

// Amount of liquidity, L.

uint128 public liquidity;

// Ticks info

mapping(int24 => Tick.Info) public ticks;

// Positions info

mapping(bytes32 => Position.Info) public positions;

...

Uniswap V3 uses many helper contracts and Tick and Position are two of them. using A for B is a feature of Solidity that lets you extend type B with functions from library contract A. This simplifies managing complex data structures.

For brevity, I’ll omit a detailed explanation of Solidity syntax and features. Solidity has great documentation, don’t hesitate to refer to it if something is not clear!

We’ll then initialize some of the variables in the constructor:

constructor(

address token0_,

address token1_,

uint160 sqrtPriceX96,

int24 tick

) {

token0 = token0_;

token1 = token1_;

slot0 = Slot0({sqrtPriceX96: sqrtPriceX96, tick: tick});

}

}

Here, we’re setting the token address immutables and setting the current price and tick–we don’t need to provide liquidity for the latter.

This is our starting point, and our goal in this chapter is to make our first swap using pre-calculated and hard-coded values.

Minting

The process of providing liquidity in Uniswap V2 is called minting. The reason is that the V2 pool contract mints tokens (LP-tokens) in exchange for liquidity. V3 doesn’t do that, but it still uses the same name for the function. Let’s use it as well:

function mint(

address owner,

int24 lowerTick,

int24 upperTick,

uint128 amount

) external returns (uint256 amount0, uint256 amount1) {

...

Our mint function will take:

- Owner’s address, to track the owner of the liquidity.

- Upper and lower ticks, to set the bounds of a price range.

- The amount of liquidity we want to provide.

Notice that user specifies , not actual token amounts. This is not very convenient of course, but recall that the Pool contract is a core contract–it’s not intended to be user-friendly because it should implement only the core logic. In a later chapter, we’ll make a helper contract that will convert token amounts to before calling

Pool.mint.

Let’s outline a quick plan of how minting will work:

- a user specifies a price range and an amount of liquidity;

- the contract updates the

ticksandpositionsmappings; - the contract calculates token amounts the user must send (we’ll pre-calculate and hard code them);

- the contract takes tokens from the user and verifies that the correct amounts were set.

Let’s begin with checking the ticks:

if (

lowerTick >= upperTick ||

lowerTick < MIN_TICK ||

upperTick > MAX_TICK

) revert InvalidTickRange();

And ensuring that some amount of liquidity is provided:

if (amount == 0) revert ZeroLiquidity();

Then, add a tick and a position:

ticks.update(lowerTick, amount);

ticks.update(upperTick, amount);

Position.Info storage position = positions.get(

owner,

lowerTick,

upperTick

);

position.update(amount);

The ticks.update function is:

// src/lib/Tick.sol

function update(

mapping(int24 => Tick.Info) storage self,

int24 tick,

uint128 liquidityDelta

) internal {

Tick.Info storage tickInfo = self[tick];

uint128 liquidityBefore = tickInfo.liquidity;

uint128 liquidityAfter = liquidityBefore + liquidityDelta;

if (liquidityBefore == 0) {

tickInfo.initialized = true;

}

tickInfo.liquidity = liquidityAfter;

}

It initializes a tick if it has 0 liquidity and adds new liquidity to it. As you can see, we’re calling this function on both lower and upper ticks, thus liquidity is added to both of them.

The position.update function is:

// src/libs/Position.sol

function update(Info storage self, uint128 liquidityDelta) internal {

uint128 liquidityBefore = self.liquidity;

uint128 liquidityAfter = liquidityBefore + liquidityDelta;

self.liquidity = liquidityAfter;

}

Similar to the tick update function, it adds liquidity to a specific position. To get a position we call:

// src/libs/Position.sol

...

function get(

mapping(bytes32 => Info) storage self,

address owner,

int24 lowerTick,

int24 upperTick

) internal view returns (Position.Info storage position) {

position = self[

keccak256(abi.encodePacked(owner, lowerTick, upperTick))

];

}

...

Each position is uniquely identified by three keys: owner address, lower tick index, and upper tick index. We hash the three to make storing data cheaper: when hashed, every key will take 32 bytes, instead of 96 bytes when owner, lowerTick, and upperTick are separate keys.

If we use three keys, we need three mappings. Each key would be stored separately and would take 32 bytes since Solidity stores values in 32-byte slots (when packing is not applied).

Next, continuing with minting, we need to calculate the amounts that the user must deposit. Luckily, we have already figured out the formulas and calculated the exact amounts in the previous part. So, we’re going to hard-code them:

amount0 = 0.998976618347425280 ether;

amount1 = 5000 ether;

We’ll replace these with actual calculations in a later chapter.

We will also update the liquidity of the pool, based on the amount being added.

liquidity += uint128(amount);

Now, we’re ready to take tokens from the user. This is done via a callback:

function mint(...) ... {

...

uint256 balance0Before;

uint256 balance1Before;

if (amount0 > 0) balance0Before = balance0();

if (amount1 > 0) balance1Before = balance1();

IUniswapV3MintCallback(msg.sender).uniswapV3MintCallback(

amount0,

amount1

);

if (amount0 > 0 && balance0Before + amount0 > balance0())

revert InsufficientInputAmount();

if (amount1 > 0 && balance1Before + amount1 > balance1())

revert InsufficientInputAmount();

...

}

function balance0() internal returns (uint256 balance) {

balance = IERC20(token0).balanceOf(address(this));

}

function balance1() internal returns (uint256 balance) {

balance = IERC20(token1).balanceOf(address(this));

}

First, we record current token balances. Then we call the uniswapV3MintCallback method on the caller–this is the callback. It’s expected that the caller (whoever calls mint) is a contract because non-contract addresses cannot implement functions in Ethereum. Using a callback here, while not being user-friendly at all, lets the contract calculate token amounts using its current state–this is critical because we cannot trust users.

The caller is expected to implement uniswapV3MintCallback and transfer tokens to the Pool contract in this function. After calling the callback function, we continue with checking whether the Pool contract balances have changed or not: we require them to increase by at least amount0 and amount1 respectively–this would mean the caller has transferred tokens to the pool.

Finally, we’re firing a Mint event:

emit Mint(msg.sender, owner, lowerTick, upperTick, amount, amount0, amount1);

Events is how contract data is indexed in Ethereum for later search. It’s a good practice to fire an event whenever the contract’s state is changed to let blockchain explorer know when this happened. Events also carry useful information. In our case, it’s the caller’s address, the liquidity position owner’s address, upper and lower ticks, new liquidity, and token amounts. This information will be stored as a log, and anyone else will be able to collect all contract events and reproduce the activity of the contract without traversing and analyzing all blocks and transactions.

And we’re done! Phew! Now, let’s test minting.

Testing

At this point, we don’t know if everything works correctly. Before deploying our contract anywhere we’re going to write a bunch of tests to ensure the contract works correctly. Luckily for us, Forge is a great testing framework and it’ll make testing a breeze.

Create a new test file:

// test/UniswapV3Pool.t.sol

// SPDX-License-Identifier: UNLICENSED

pragma solidity ^0.8.14;

import "forge-std/Test.sol";

contract UniswapV3PoolTest is Test {

function setUp() public {}

function testExample() public {

assertTrue(true);

}

}

Let’s run it:

$ forge test

Running 1 test for test/UniswapV3Pool.t.sol:UniswapV3PoolTest

[PASS] testExample() (gas: 279)

Test result: ok. 1 passed; 0 failed; finished in 5.07ms

It passes! Of course, it is! So far, our test only checks that true is true!

Test contracts are just contracts that inherit from forge-std/Test.sol. This contract is a set of testing utilities, we’ll get acquainted with them step by step. If you don’t want to wait, open lib/forge-std/src/Test.sol and skim through it.

Test contracts follow a specific convention:

setUpfunction is used to set up test cases. In each test case, we want to have a configured environment, like deployed contracts, minted tokens, and initialized pools–we’ll do all this insetUp.- Every test case starts with the

testprefix, e.g.testMint(). This will let Forge distinguish test cases from helper functions (we can also have any function we want).

Let’s now actually test minting.

Test Tokens

To test minting we need tokens. This is not a problem because we can deploy any contract in tests! Moreover, Forge can install open-source contracts as dependencies. Specifically, we need an ERC20 contract with minting functionality. We’ll use the ERC20 contract from Solmate, a collection of gas-optimized contracts, and make an ERC20 contract that inherits from the Solmate contract and exposes minting (it’s public by default).

Let’s install solmate:

$ forge install rari-capital/solmate

Then, let’s create the ERC20Mintable.sol contract in the test folder (we’ll use the contract only in tests):

// SPDX-License-Identifier: UNLICENSED

pragma solidity ^0.8.14;

import "solmate/tokens/ERC20.sol";

contract ERC20Mintable is ERC20 {

constructor(

string memory _name,

string memory _symbol,

uint8 _decimals

) ERC20(_name, _symbol, _decimals) {}

function mint(address to, uint256 amount) public {

_mint(to, amount);

}

}

Our ERC20Mintable inherits all functionality from solmate/tokens/ERC20.sol and we additionally implement the public mint method which will allow us to mint any number of tokens.

Minting

Now, we’re ready to test minting.

First, let’s deploy all the required contracts:

// test/UniswapV3Pool.t.sol

...

import "./ERC20Mintable.sol";

import "../src/UniswapV3Pool.sol";

contract UniswapV3PoolTest is Test {

ERC20Mintable token0;

ERC20Mintable token1;

UniswapV3Pool pool;

function setUp() public {

token0 = new ERC20Mintable("Ether", "ETH", 18);

token1 = new ERC20Mintable("USDC", "USDC", 18);

}

...

In the setUp function, we deploy tokens but not pools! This is because all our test cases will use the same tokens but each of them will have a unique pool.

To make the setting up of pools cleaner and simpler, we’ll do this in a separate function, setupTestCase, that takes a set of test case parameters. In our first test case, we’ll test successful liquidity minting. This is what the test case parameters look like:

function testMintSuccess() public {

TestCaseParams memory params = TestCaseParams({

wethBalance: 1 ether,

usdcBalance: 5000 ether,

currentTick: 85176,

lowerTick: 84222,

upperTick: 86129,

liquidity: 1517882343751509868544,

currentSqrtP: 5602277097478614198912276234240,

shouldTransferInCallback: true,

mintLiqudity: true

});

- We’re planning to deposit 1 ETH and 5000 USDC into the pool.

- We want the current tick to be 85176, and the lower and upper ticks to be 84222 and 86129 respectively (we calculated these values in the previous chapter).

- We’re specifying the precalculated liquidity and current .

- We also want to deposit liquidity (

mintLiquidityparameter) and transfer tokens when requested by the pool contract (shouldTransferInCallback). We don’t want to do this in each test case, so we want to have the flags.

Next, we’re calling setupTestCase with the above parameters:

function setupTestCase(TestCaseParams memory params)

internal

returns (uint256 poolBalance0, uint256 poolBalance1)

{

token0.mint(address(this), params.wethBalance);

token1.mint(address(this), params.usdcBalance);

pool = new UniswapV3Pool(

address(token0),

address(token1),

params.currentSqrtP,

params.currentTick

);

if (params.mintLiqudity) {

(poolBalance0, poolBalance1) = pool.mint(

address(this),

params.lowerTick,

params.upperTick,

params.liquidity

);

}

shouldTransferInCallback = params.shouldTransferInCallback;

}

In this function, we’re minting tokens and deploying a pool. Also, when the mintLiquidity flag is set, we mint liquidity in the pool. In the end, we’re setting the shouldTransferInCallback flag for it to be read in the mint callback:

function uniswapV3MintCallback(uint256 amount0, uint256 amount1) public {

if (shouldTransferInCallback) {

token0.transfer(msg.sender, amount0);

token1.transfer(msg.sender, amount1);

}

}

It’s the test contract that will provide liquidity and will call the mint function on the pool, there’re no users. The test contract will act as a user, thus it can implement the mint callback function.

Setting up test cases like that is not mandatory, you can do it however feels most comfortable to you. Test contracts are just contracts.

In testMintSuccess, we want to ensure that the pool contract:

- takes the correct amounts of tokens from us;

- creates a position with correct key and liquidity;

- initializes the upper and lower ticks we’ve specified;

- has correct and .

Let’s do this.

Minting happens in setupTestCase, so we don’t need to do this again. The function also returns the amounts we have provided, so let’s check them:

(uint256 poolBalance0, uint256 poolBalance1) = setupTestCase(params);

uint256 expectedAmount0 = 0.998976618347425280 ether;

uint256 expectedAmount1 = 5000 ether;

assertEq(

poolBalance0,

expectedAmount0,

"incorrect token0 deposited amount"

);

assertEq(

poolBalance1,

expectedAmount1,

"incorrect token1 deposited amount"

);

We expect specific pre-calculated amounts. And we can also check that these amounts were transferred to the pool:

assertEq(token0.balanceOf(address(pool)), expectedAmount0);

assertEq(token1.balanceOf(address(pool)), expectedAmount1);

Next, we need to check the position the pool created for us. Remember that the key in positions mapping is a hash? We need to calculate it manually and then get our position from the contract:

bytes32 positionKey = keccak256(

abi.encodePacked(address(this), params.lowerTick, params.upperTick)

);

uint128 posLiquidity = pool.positions(positionKey);

assertEq(posLiquidity, params.liquidity);

Since

Position.Infois a struct, it gets destructured when fetched: each field gets assigned to a separate variable.

Next, come the ticks. Again, it’s straightforward:

(bool tickInitialized, uint128 tickLiquidity) = pool.ticks(

params.lowerTick

);

assertTrue(tickInitialized);

assertEq(tickLiquidity, params.liquidity);

(tickInitialized, tickLiquidity) = pool.ticks(params.upperTick);

assertTrue(tickInitialized);

assertEq(tickLiquidity, params.liquidity);

And finally, and :

(uint160 sqrtPriceX96, int24 tick) = pool.slot0();

assertEq(

sqrtPriceX96,

5602277097478614198912276234240,

"invalid current sqrtP"

);

assertEq(tick, 85176, "invalid current tick");

assertEq(

pool.liquidity(),

1517882343751509868544,

"invalid current liquidity"

);

As you can see, writing tests in Solidity is not hard!

Failures

Of course, testing only successful scenarios is not enough. We also need to test failing cases. What can go wrong when providing liquidity? Here are a couple of hints:

- Upper and lower ticks are too big or too small.

- Zero liquidity is provided.

- The liquidity provider doesn’t have enough tokens.

I’ll leave it to you to implement these scenarios! Feel free to peek at the code in the repo.

First Swap

Now that we have liquidity, we can make our first swap!

Calculating Swap Amounts

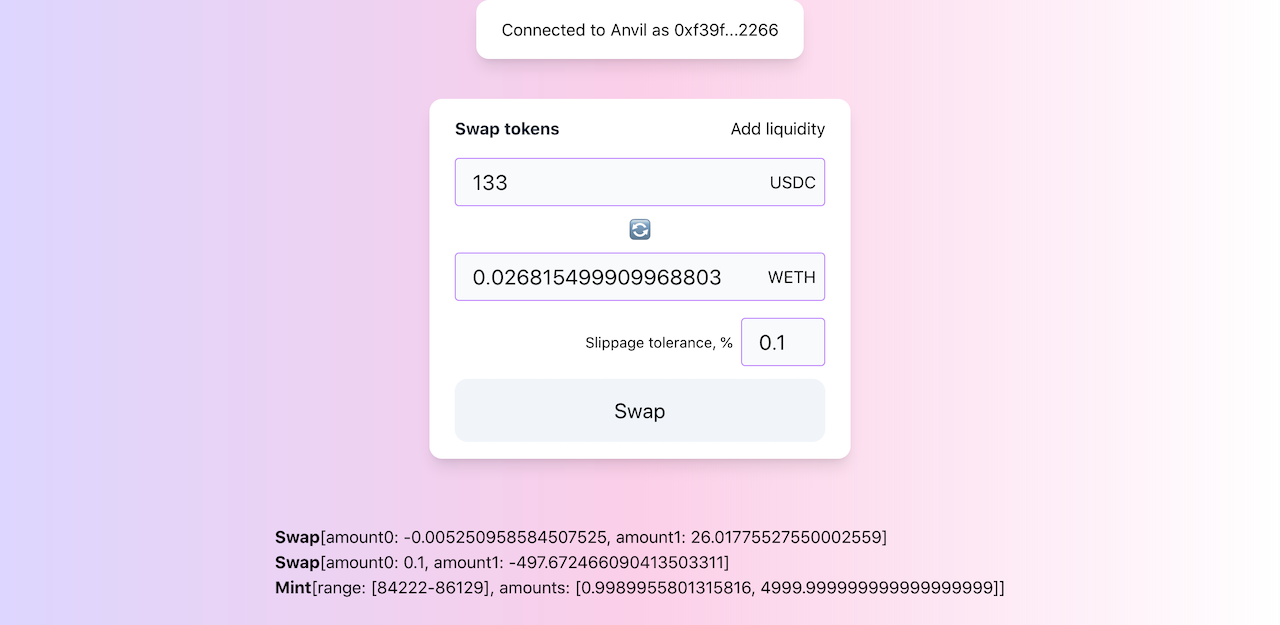

The first step, of course, is to figure out how to calculate swap amounts. And, again, let’s pick and hardcode some amount of USDC we’re going to trade in for ETH. Let it be 42! We’re going to buy ETH for 42 USDC.

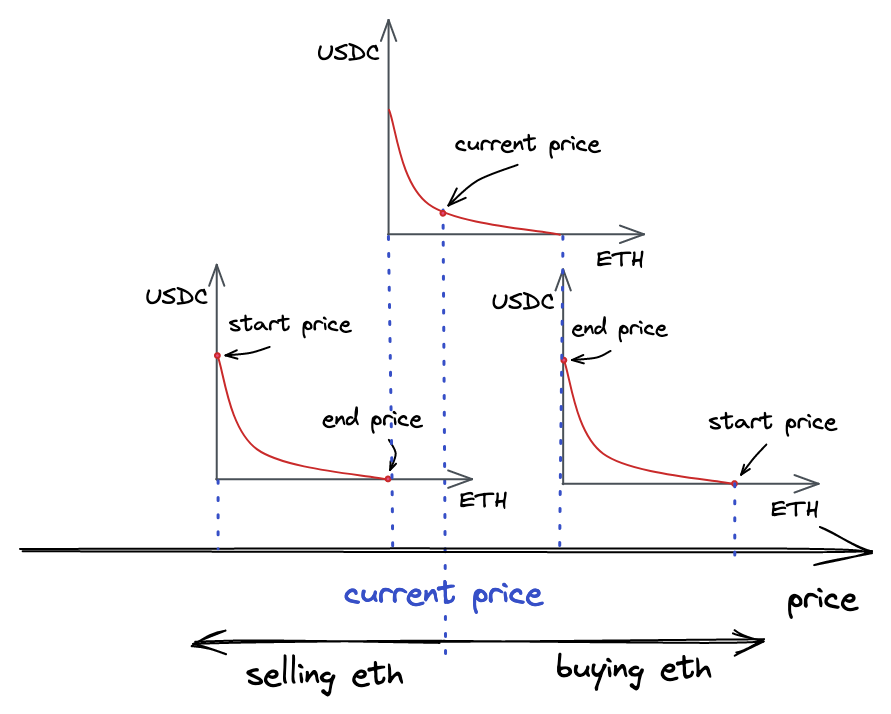

After deciding how many tokens we want to sell, we need to calculate how many tokens we’ll get in exchange. In Uniswap V2, we would’ve used current pool reserves, but in Uniswap V3 we have and and we know the fact that when swapping within a price range, only changes and remains unchanged (Uniswap V3 acts exactly as V2 when swapping is done only within one price range). We also know that:

And… we know ! This is the 42 USDC we’re going to trade in! Thus, we can find how selling 42 USDC will affect the current given the :

In Uniswap V3, we choose the price we want our trade to lead to (recall that swapping changes the current price, i.e. it moves the current price along the curve). Knowing the target price, the contract will calculate the amount of input token it needs to take from us and the respective amount of output token it’ll give us.

Let’s plug our numbers into the above formula:

After adding this to the current , we’ll get the target price:

To calculate the target price in Python:

amount_in = 42 * eth price_diff = (amount_in * q96) // liq price_next = sqrtp_cur + price_diff print("New price:", (price_next / q96) ** 2) print("New sqrtP:", price_next) print("New tick:", price_to_tick((price_next / q96) ** 2)) # New price: 5003.913912782393 # New sqrtP: 5604469350942327889444743441197 # New tick: 85184

After finding the target price, we can calculate token amounts using the amounts calculation functions from a previous chapter:

In Python:

amount_in = calc_amount1(liq, price_next, sqrtp_cur) amount_out = calc_amount0(liq, price_next, sqrtp_cur) print("USDC in:", amount_in / eth) print("ETH out:", amount_out / eth) # USDC in: 42.0 # ETH out: 0.008396714242162444

To verify the amounts, let’s recall another formula:

Using this formula, we can find the amount of ETH we’re buying, , knowing the price change, , and liquidity . Be careful though: is not ! The former is the change in the price of ETH, and it can be found using this expression:

Luckily, we already know all the values, so we can plug them in right away (this might not fit on your screen!):

Now, let’s find :

Which is 0.008396714242162698 ETH, and it’s very close to the amount we found above! Notice that this amount is negative since we’re removing it from the pool.

Implementing a Swap

Swapping is implemented in the swap function:

function swap(address recipient)

public

returns (int256 amount0, int256 amount1)

{

...

At this moment, it only takes a recipient, who is a receiver of tokens.

First, we need to find the target price and tick, as well as calculate the token amounts. Again, we’ll simply hard-code the values we calculated earlier to keep things as simple as possible:

...

int24 nextTick = 85184;

uint160 nextPrice = 5604469350942327889444743441197;

amount0 = -0.008396714242162444 ether;

amount1 = 42 ether;

...

Next, we need to update the current tick and sqrtP since trading affects the current price:

...

(slot0.tick, slot0.sqrtPriceX96) = (nextTick, nextPrice);

...

Next, the contract sends tokens to the recipient and lets the caller transfer the input amount into the contract:

...

IERC20(token0).transfer(recipient, uint256(-amount0));

uint256 balance1Before = balance1();

IUniswapV3SwapCallback(msg.sender).uniswapV3SwapCallback(

amount0,

amount1

);

if (balance1Before + uint256(amount1) < balance1())

revert InsufficientInputAmount();

...

Again, we’re using a callback to pass the control to the caller and let it transfer the tokens. After that, we check that the pool’s balance is correct and includes the input amount.

Finally, the contract emits a Swap event to make the swap discoverable. The event includes all the information about the swap:

...

emit Swap(

msg.sender,

recipient,

amount0,

amount1,

slot0.sqrtPriceX96,

liquidity,

slot0.tick

);

And that’s it! The function simply sends some amount of tokens to the specified recipient address and expects a certain number of the other tokens in exchange. Throughout this book, the function will get much more complicated.

Testing Swapping

Now, we can test the swap function. In the same test file, create the testSwapBuyEth function and set up the test case. This test case uses the same parameters as testMintSuccess:

function testSwapBuyEth() public {

TestCaseParams memory params = TestCaseParams({

wethBalance: 1 ether,

usdcBalance: 5000 ether,

currentTick: 85176,

lowerTick: 84222,

upperTick: 86129,

liquidity: 1517882343751509868544,

currentSqrtP: 5602277097478614198912276234240,

shouldTransferInCallback: true,

mintLiqudity: true

});

(uint256 poolBalance0, uint256 poolBalance1) = setupTestCase(params);

...

The next steps will be different, however.

We’re not going to test that liquidity has been correctly added to the pool since we tested this functionality in the other test cases.

To make the test swap, we need 42 USDC:

token1.mint(address(this), 42 ether);

Before making the swap, we need to ensure we can transfer tokens to the pool contract when it requests them:

function uniswapV3SwapCallback(int256 amount0, int256 amount1) public {

if (amount0 > 0) {

token0.transfer(msg.sender, uint256(amount0));

}

if (amount1 > 0) {

token1.transfer(msg.sender, uint256(amount1));

}

}

Since amounts during a swap can be positive (the amount that’s sent to the pool) and negative (the amount that’s taken from the pool), in the callback, we only want to send the positive amount, i.e. the amount we’re trading in.

Now, we can call swap:

(int256 amount0Delta, int256 amount1Delta) = pool.swap(address(this));

The function returns token amounts used in the swap, and we can check them right away:

assertEq(amount0Delta, -0.008396714242162444 ether, "invalid ETH out");

assertEq(amount1Delta, 42 ether, "invalid USDC in");

Then, we need to ensure that tokens were transferred from the caller:

assertEq(

token0.balanceOf(address(this)),

uint256(userBalance0Before - amount0Delta),

"invalid user ETH balance"

);

assertEq(

token1.balanceOf(address(this)),

0,

"invalid user USDC balance"

);

And sent to the pool contract:

assertEq(

token0.balanceOf(address(pool)),

uint256(int256(poolBalance0) + amount0Delta),

"invalid pool ETH balance"

);

assertEq(

token1.balanceOf(address(pool)),

uint256(int256(poolBalance1) + amount1Delta),

"invalid pool USDC balance"

);

Finally, we’re checking that the pool state was updated correctly:

(uint160 sqrtPriceX96, int24 tick) = pool.slot0();

assertEq(

sqrtPriceX96,

5604469350942327889444743441197,

"invalid current sqrtP"

);

assertEq(tick, 85184, "invalid current tick");

assertEq(

pool.liquidity(),

1517882343751509868544,

"invalid current liquidity"

);

Notice that swapping doesn’t change the current liquidity–in a later chapter, we’ll see when it does change it.

Homework

Write a test that fails with an InsufficientInputAmount error. Keep in mind that there’s a hidden bug 🙂

Manager Contract

Before deploying our pool contract, we need to solve one problem. As you remember, Uniswap V3 contracts are split into two categories:

- Core contracts that implement the core functions and don’t provide user-friendly interfaces.

- Periphery contracts that implement user-friendly interfaces for the core contracts.

The pool contract is a core contract, it’s not supposed to be user-friendly and flexible. It expects the caller to do all the calculations (prices, amounts) and to provide proper call parameters. It also doesn’t use ERC20’s transferFrom to transfer tokens from the caller. Instead, it uses two callbacks:

uniswapV3MintCallback, which is called when minting liquidity;uniswapV3SwapCallback, which is called when swapping tokens.

In our tests, we implemented these callbacks in the test contract. Since it’s only a contract that can implement them, the pool contract cannot be called by regular users (non-contract addresses). This is fine. But not anymore 🙂.

Our next step in the book is deploying the pool contract to a local blockchain and interacting with it from a front-end app. Thus, we need to build a contract that will let non-contract addresses interact with the pool. Let’s do this now!

Workflow

This is how the manager contract will work:

- To mint liquidity, we’ll approve the spending of tokens to the manager contract.

- We’ll then call the

mintfunction of the manager contract and pass it minting parameters, as well as the address of the pool we want to provide liquidity into. - The manager contract will call the pool’s

mintfunction and will implementuniswapV3MintCallback. It’ll have permission to send our tokens to the pool contract. - To swap tokens, we’ll also approve the spending of tokens to the manager contract.

- We’ll then call the

swapfunction of the manager contract and, similarly to minting, it’ll pass the call to the pool. The manager contract will send our tokens to the pool contract, and the pool contract will swap them and send the output amount to us.

Thus, the manager contract will act as an intermediary between users and pools.

Passing Data to Callbacks

Before implementing the manager contract, we need to upgrade the pool contract.

The manager contract will work with any pool and it’ll allow any address to call it. To achieve this, we need to upgrade the callbacks: we want to pass different pool addresses and user addresses to them. Let’s look at our current implementation of uniswapV3MintCallback (in the test contract):

function uniswapV3MintCallback(uint256 amount0, uint256 amount1) public {

if (transferInMintCallback) {

token0.transfer(msg.sender, amount0);

token1.transfer(msg.sender, amount1);

}

}

Key points here:

- The function transfers tokens belonging to the test contract–we want it to transfer tokens from the caller by using

transferFrom. - The function knows

token0andtoken1, which will be different for every pool.

Idea: we need to change the arguments of the callback so we can pass user and pool addresses.

Now, let’s look at the swap callback:

function uniswapV3SwapCallback(int256 amount0, int256 amount1) public {

if (amount0 > 0 && transferInSwapCallback) {

token0.transfer(msg.sender, uint256(amount0));

}

if (amount1 > 0 && transferInSwapCallback) {

token1.transfer(msg.sender, uint256(amount1));

}

}

Identically, it transfers tokens from the test contract and it knows token0 and token1.

To pass the extra data to the callbacks, we need to pass it to mint and swap first (since callbacks are called from these functions). However, since this extra data is not used in the functions and to not make their arguments messier, we’ll encode the extra data using abi.encode().

Let’s define the extra data as a structure:

// src/UniswapV3Pool.sol

...

struct CallbackData {

address token0;

address token1;

address payer;

}

...

And then pass encoded data to the callbacks:

function mint(

address owner,

int24 lowerTick,

int24 upperTick,

uint128 amount,

bytes calldata data // <--- New line

) external returns (uint256 amount0, uint256 amount1) {

...

IUniswapV3MintCallback(msg.sender).uniswapV3MintCallback(

amount0,

amount1,

data // <--- New line

);

...

}

function swap(address recipient, bytes calldata data) // <--- `data` added

public

returns (int256 amount0, int256 amount1)

{

...

IUniswapV3SwapCallback(msg.sender).uniswapV3SwapCallback(

amount0,

amount1,

data // <--- New line

);

...

}

Now, we can read the extra data in the callbacks in the test contract.

function uniswapV3MintCallback(

uint256 amount0,

uint256 amount1,

bytes calldata data

) public {

if (transferInMintCallback) {

UniswapV3Pool.CallbackData memory extra = abi.decode(

data,

(UniswapV3Pool.CallbackData)

);

IERC20(extra.token0).transferFrom(extra.payer, msg.sender, amount0);

IERC20(extra.token1).transferFrom(extra.payer, msg.sender, amount1);

}

}

Try updating the rest of the code yourself, and if it gets too difficult, feel free to peek at this commit.

Implementing Manager Contract

Besides implementing the callbacks, the manager contract won’t do much: it’ll simply redirect calls to a pool contract. This is a very minimalistic contract at this moment:

pragma solidity ^0.8.14;

import "../src/UniswapV3Pool.sol";

import "../src/interfaces/IERC20.sol";

contract UniswapV3Manager {

function mint(

address poolAddress_,

int24 lowerTick,

int24 upperTick,

uint128 liquidity,

bytes calldata data

) public {

UniswapV3Pool(poolAddress_).mint(

msg.sender,

lowerTick,

upperTick,

liquidity,

data

);

}

function swap(address poolAddress_, bytes calldata data) public {

UniswapV3Pool(poolAddress_).swap(msg.sender, data);

}

function uniswapV3MintCallback(...) {...}

function uniswapV3SwapCallback(...) {...}

}

The callbacks are identical to those in the test contract, with the exception that there are no transferInMintCallback and transferInSwapCallback flags since the manager contract always transfers tokens.

Well, we’re now fully prepared to deploy and integrate with a front-end app!

Deployment

Alright, our pool contract is done. Now, let’s see how we can deploy it to a local Ethereum network so we can use it from a front-end app later on.

Choosing Local Blockchain Network

Smart contracts development requires running a local network, where you deploy your contracts during development and testing. This is what we want from such a network:

- Real blockchain. It must be a real Ethereum network, not an emulation. We want to be sure that our contract will work in the local network exactly as it would in the mainnet.

- Speed. We want our transactions to be minted immediately, so we can iterate quickly.

- Ether. To pay transaction fees, we need some ether, and we want the local network to allow us to generate any amount of ether.