User Interface

We’re now ready to update the UI with the changes we made in this milestone. We’ll add two new features:

- Add Liquidity dialog window;

- slippage tolerance in swapping.

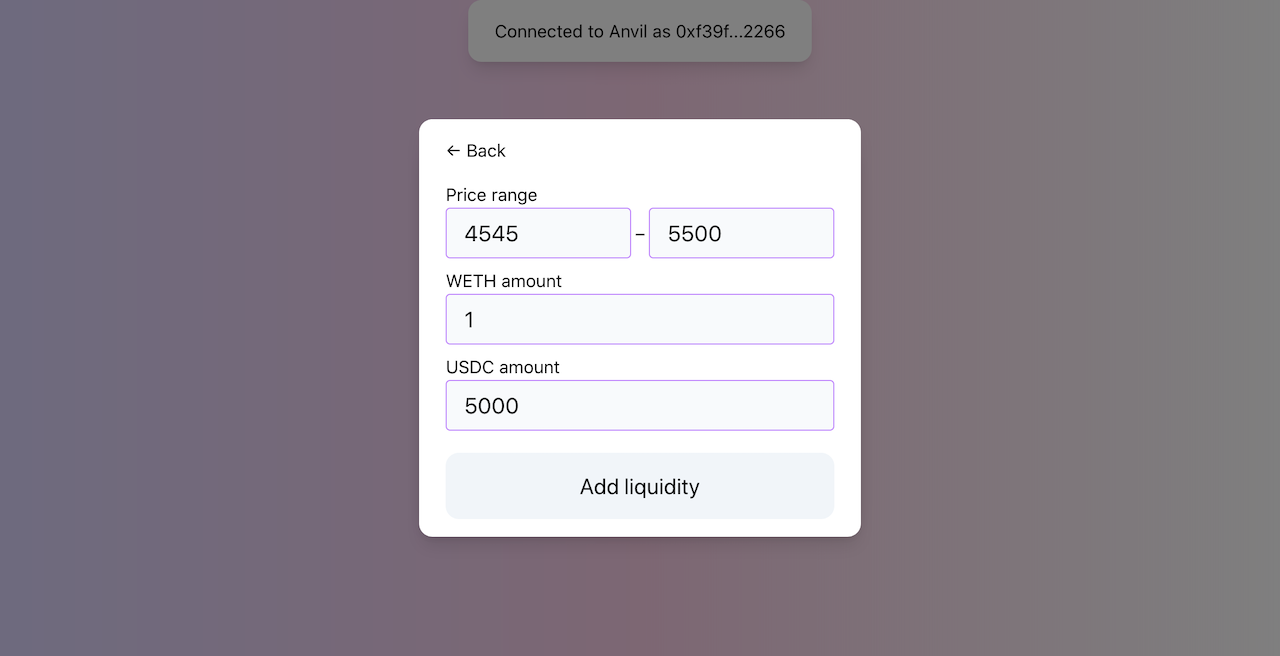

Add Liquidity Dialog

This change will finally remove hard-coded liquidity amounts from our code and will allow us to add liquidity at arbitrary ranges.

The dialog is a simple component with a couple of inputs. We can even re-use the addLiquidity function from the previous implementation. However, now we need to convert prices to tick indices in JavaScript: we want users to type in prices but the contracts expect ticks. To make our job easier, we’ll use the official Uniswap V3 SDK for that.

To convert price to , we can use encodeSqrtRatioX96 function. The function takes two amounts as input and calculates a price by dividing one by the other. Since we only want to convert price to , we can pass 1 as amount0:

const priceToSqrtP = (price) => encodeSqrtRatioX96(price, 1);

To convert price to tick index, we can use TickMath.getTickAtSqrtRatio function. This is an implementation of the Solidity TickMath library in JavaScript:

const priceToTick = (price) => TickMath.getTickAtSqrtRatio(priceToSqrtP(price));

So we can now convert prices typed in by users to ticks:

const lowerTick = priceToTick(lowerPrice);

const upperTick = priceToTick(upperPrice);

Another thing we need to add here is slippage protection. For simplicity, I made it a hard-coded value and set it to 0.5%. Here’s how to use slippage tolerance to calculate minimal amounts:

const slippage = 0.5;

const amount0Desired = ethers.utils.parseEther(amount0);

const amount1Desired = ethers.utils.parseEther(amount1);

const amount0Min = amount0Desired.mul((100 - slippage) * 100).div(10000);

const amount1Min = amount1Desired.mul((100 - slippage) * 100).div(10000);

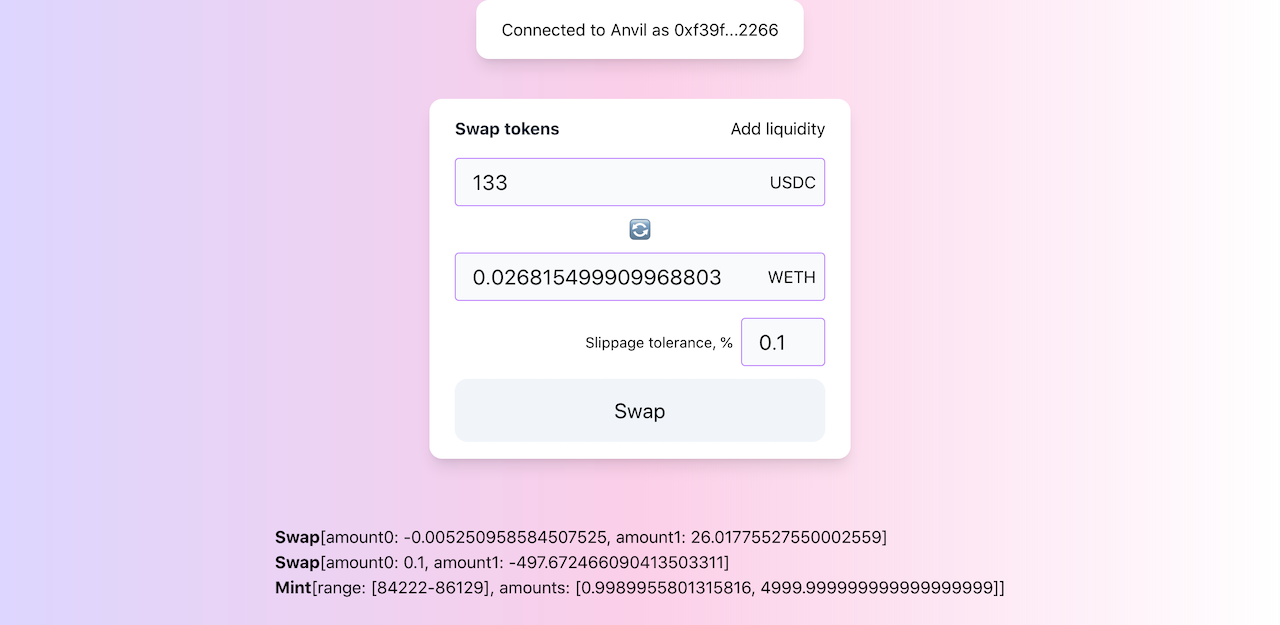

Slippage Tolerance in Swapping

Even though we’re the only users of the application and thus will never have problems with slippage during development, let’s add an input to control slippage tolerance during swaps.

When swapping, slippage protection is implemented via limiting price–a price we don’t to go above or below during a swap. This means that we need to know this price before sending a swap transaction. However, we don’t need to calculate it on the front end because the Quoter contract does this for us:

function quote(QuoteParams memory params)

public

returns (

uint256 amountOut,

uint160 sqrtPriceX96After,

int24 tickAfter

) { ... }

And we’re calling Quoter to calculate swap amounts.

So, to calculate the limiting price we need to take sqrtPriceX96After and subtract slippage tolerance from it–this will be the price we don’t want to go below during a swap.

const limitPrice = priceAfter.mul((100 - parseFloat(slippage)) * 100).div(10000);

And that’s it!